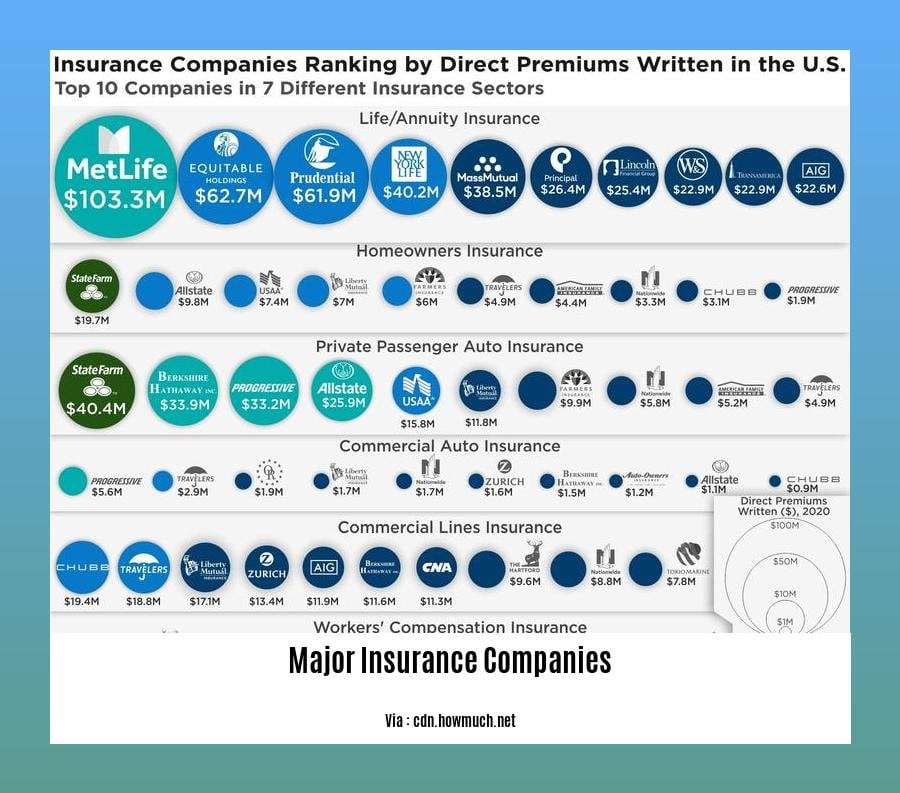

Prepare to delve into the captivating world of insurance as we unpack the major players shaping this dynamic industry. In our article, “Major Insurance Companies: Industry Leaders and Market Trends,” we’ll venture into the realm of these insurance behemoths, uncovering their strategies, competitive landscapes, and the forces driving their growth.

Key Takeaways:

- Berkshire Hathaway is the world’s leading insurance company.

- Ping An Insurance (Group) Co. of China Ltd. is the second largest insurer globally.

- Allianz SE, AXA SA, MetLife Inc., Prudential PLC, American International Group Inc., Allstate Corp., and Chubb are prominent insurance companies worldwide.

- AXA Group, Chubb, and American International Group (AIG) have made significant progress in the industry rankings, with AIG entering the top 10.

Major Insurance Companies

Let’s dive into the world of insurance giants!

Understanding the Insurance Landscape:

In a world of uncertainty, major insurance companies provide a safety net, protecting us from life’s unpredictable events. These colossal entities are the backbone of the insurance industry, shaping its landscape and influencing the lives of millions worldwide.

The Who’s Who of Insurance:

Dominating the insurance realm, we have industry titans like Berkshire Hathaway, the undisputed king of the insurance world. Hailing from China, Ping An Insurance stands tall as the world’s second-largest insurer. European powerhouses like Allianz SE and AXA SA hold their ground among the industry leaders.

On the Rise:

Several major insurance companies have been making waves in recent times. AXA Group, Chubb, and American International Group (AIG) have ascended the industry ranks, with AIG breaking into the top 10. Their agility and innovation have fueled their rise in an ever-evolving market.

Navigating the Insurance Market:

In the face of numerous major insurance companies vying for your attention, choosing the right one can be a daunting task. To make an informed decision, consider factors such as financial stability, coverage options, customer service, and industry reputation.

The Bottom Line:

Major insurance companies play a crucial role in mitigating risks and safeguarding individuals and businesses alike. Their financial strength, extensive coverage, and innovative approaches ensure peace of mind in the face of life’s uncertainties. As the industry continues to evolve, these giants will undoubtedly shape its trajectory, ensuring the well-being of millions worldwide.

Do you know the history of insurance and how it has evolved over time? From its humble beginnings to its modern-day complexities, the insurance industry has played a pivotal role in shaping our financial landscape.

If you’re curious about the various types of insurance available, from auto insurance to health insurance and everything in between, we’ve got you covered. Check out our comprehensive guide to different types of insurance.

Delve into the development of the insurance industry and explore how it has adapted to meet the changing needs of society. From the early days of marine insurance to the rise of life insurance and the emergence of modern risk management techniques, the insurance industry has continuously innovated to provide financial protection and peace of mind.

Geographical Reach and International Presence

The insurance industry spans across geographical borders, serving clients worldwide. Major insurance companies have established a global footprint, offering their services in multiple countries and regions. They leverage their international presence to diversify their risk portfolio, tap into new markets, and cater to the insurance needs of a globalized economy.

Key Takeaways:

- Insurance companies have a significant global reach, with major players operating in numerous countries.

- Geographical diversification allows insurers to mitigate risks and stabilize their financial performance.

- International expansion provides access to new markets, customer segments, and growth opportunities.

- Insurers with a strong international presence often have a competitive advantage due to their ability to serve clients across borders.

- The Forbes Global 2000 list includes several insurance companies with extensive global operations.

Citation:

Forbes Global 2000: The World’s Largest Insurance Companies In 2021

Key Growth Strategies and Innovations

The insurance industry continues to evolve and grow, driven by expanding digital capabilities, heightened focus on corporate social responsibility, hyper-personalized offerings, promotion of Diversity and Inclusion (D&I), and flexible pricing structures. These Key Growth Strategies and Innovations are reshaping the landscape for insurance companies, helping them stay competitive in a market filled with new opportunities and challenges.

1. Enhance Digital Capabilities

Digital transformation is at the forefront of insurance innovation, with consumers demanding convenient and tech-savvy experiences. Companies are investing heavily in digital tools, platforms, and automation to streamline operations, personalize services, and improve customer engagement.

2. Implement Corporate Social Responsibility (CSR)

CSR initiatives are crucial for building brand reputation and attracting socially conscious consumers. Insurance companies are aligning their values with sustainability efforts, community involvement, and ethical practices to make a meaningful impact on society.

3. Foster Hyper-Personalization

Consumers expect tailored experiences that meet their specific needs. Insurance companies are leveraging data and analytics to personalize products, pricing, and services to create unique value propositions for individual customers.

4. Promote Diversity and Inclusion (D&I)

Diversity and Inclusion initiatives create a more inclusive and equitable workplace, fostering innovation and enhancing employee retention. Insurance companies are recognizing the benefits of a diverse workforce, ensuring equal opportunities for all.

5. Implement Flexible Pricing Structures

Flexible pricing models cater to the diverse financial situations of customers. By offering customized pricing options and payment plans, insurance companies make coverage more affordable and accessible, driving growth.

Key Takeaways:

- Digitalization is transforming the insurance landscape, with companies investing in advanced technologies.

- CSR initiatives enhance brand reputation and attract socially conscious consumers.

- Hyper-personalized offerings meet the unique needs of individual customers.

- Diversity and Inclusion initiatives foster innovation and employee engagement.

- Flexible pricing structures make insurance more affordable and accessible.

Relevant URL Source:

- 5 Growth Strategies from Top-Rated Insurance Companies

Industry Outlook and Future Trends: Shaping the Insurance Landscape

The insurance industry is evolving dynamically, and understanding its future trends is critical for stakeholders. Let’s dive into key developments and their implications:

Rising Inflation’s Impact on Underwriting Profitability

Soaring inflation is pushing up insurance premiums, but it’s also driving up loss costs. This squeeze is hurting underwriting profitability and forcing insurers to reassess their strategies.

Heightened Competition Through Portfolio Expansion

To stay competitive, insurers are diversifying their portfolios by partnering with other providers and vendors. This collaboration fosters new products and services, attracting a wider customer base.

Embracing Innovation to Address Challenges

The industry is grappling with rising inflation, interest rates, and loss costs. Insurers are leveraging technology and embracing customer-centricity to navigate these headwinds.

Digital Transformation’s Role in Shaping the Future

Forced virtualization and remote work have accelerated digital transformation in the insurance industry. Insurers are investing heavily in technology to enhance customer experiences, automate processes, and drive efficiency.

Key Takeaways:

- Inflation presents both opportunities and challenges for insurers.

- Portfolio expansion through partnerships is a key growth strategy.

- Innovation is crucial to address industry challenges.

- Digital transformation is reshaping customer experiences and operations.

Most Relevant URL Source:

- 2024 Global Insurance Outlook

FAQ

Q1: Who are the largest insurance companies in the world?

A1: Berkshire Hathaway, Ping An Insurance (Group) Co. of China Ltd., Allianz SE, AXA SA, MetLife Inc, Prudential PLC, American International Group Inc., Allstate Corp., and Chubb are among the world’s largest insurance companies.

Q2: Which insurance companies have moved up in the rankings?

A2: AXA Group, Chubb, and American International Group (AIG) have moved up the rankings, with AIG breaking into the top 10.

Q3: What is the impact of digital adoption on the insurance industry?

A3: Digital adoption is expected to enhance innovation and competition within the insurance sector, as consumers increasingly demand digital capabilities.

Q4: Why is it important for insurers to foster hyper-personalization?

A4: Consumers expect insurance offerings that are tailored to their specific needs, making hyper-personalization crucial for growth.

Q5: How are insurers responding to challenges such as rising inflation and interest rates?

A5: Insurers are embracing innovation and customer-centricity to respond to challenges such as rising inflation, interest rates, and loss costs.

- Mastering Leader in Spanish: The Complete Guide - April 19, 2025

- Uncovering Surprising Parallels: England Size Compared to US States - April 19, 2025

- Old Mexico Map: Border Shifts 1821-1857 - April 19, 2025