Introducing [A Guide to Different Types of Insurance for All Your Coverage Needs], your trusted source for navigating the intricate world of insurance. Whether you’re an individual seeking protection for your personal assets or a business owner safeguarding your enterprise, this comprehensive guide will empower you to make informed decisions for your coverage needs. Our expert insights and accessible explanations will help you understand the complexities of insurance policies, ensuring you choose the right coverage for your unique risks.

Key Takeaways:

-

Insurance protects against financial risks and ensures coverage in case of unforeseen mishaps.

-

There are various insurance types tailored to specific needs, such as life, health, vehicle, home, travel, and more.

-

Primary insurance categories include auto, home/renters, health, life, and umbrella insurance.

-

Auto insurance covers vehicle damage and liabilities.

-

Homeowners/renters insurance protects property and belongings.

-

Health insurance provides financial security for medical expenses.

-

Life insurance offers financial support to beneficiaries upon the insured’s passing.

-

Umbrella insurance enhances liability coverage beyond the limits of other policies.

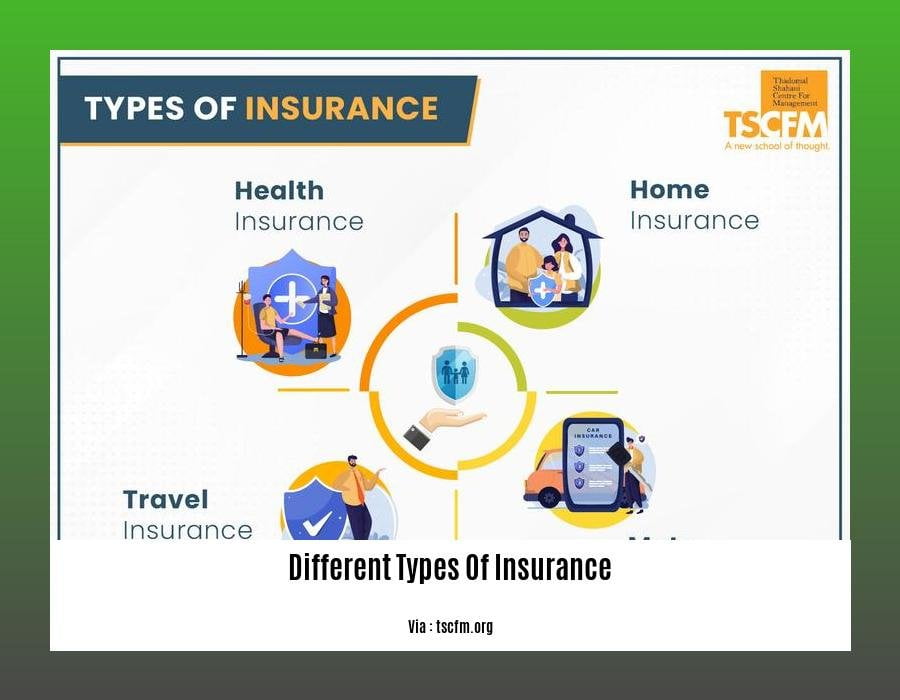

Different Types of Insurance

Are you navigating the maze of different types of insurance and feeling overwhelmed? Let’s break it down to help you find the right coverage for your unique needs.

Primary Types of Insurance

- Auto Insurance: Essential for protecting your vehicle, yourself, and others on the road. Covers bodily injury, property damage, and collision.

- Homeowners/Renters Insurance: Safeguards your property and belongings against fire, theft, vandalism, and various perils.

- Health Insurance: Covers medical expenses, doctor visits, hospital stays, and prescriptions, providing peace of mind when health concerns arise.

- Life Insurance: Provides financial support for your loved ones if you pass away unexpectedly.

- Umbrella Insurance: Extends liability coverage beyond the limits of other policies, giving you extra protection.

Specialized Types of Insurance

- Disability Insurance: Replaces lost income if you can’t work due to illness or injury.

- Long-Term Care Insurance: Covers costs associated with long-term nursing home or home health care.

- Travel Insurance: Protects you against unexpected events like trip cancellations, medical emergencies, and lost luggage while traveling.

Choosing the Right Insurance

Selecting the different types of insurance that are right for you is crucial. Consider factors like your age, health, lifestyle, and financial situation. Here’s a simple step-by-step guide:

- Identify Your Needs: Determine the risks you need to protect against.

- Research and Compare: Explore different insurance companies and policies to find the best coverage at the right price.

- Consider Optional Coverage: Assess if add-ons like additional liability or renter’s equipment coverage enhance your protection.

Remember: Insurance is not one-size-fits-all. By understanding the different types of insurance available and tailoring your coverage to your specific needs, you can safeguard yourself and your loved ones against financial setbacks.

Insurance has a long and fascinating history, with roots in ancient civilizations. To delve into the history of insurance, you can explore its origins, key milestones, and the evolution of insurance practices over time.

The insurance industry has grown exponentially over the years, with major insurance companies playing a significant role in shaping the market. Discover the major insurance companies, their market share, and the competitive landscape within the industry.

The development of the insurance industry has been influenced by a multitude of factors. Explore the development of the insurance industry to understand how regulations, technological advancements, and societal changes have shaped the industry’s evolution.

Auto insurance: Essential information, coverage options, and legal requirements

Auto insurance is designed to protect you financially in the event of an accident. It covers damages to your vehicle, as well as injuries to yourself and others. In most states, it’s required to carry at least liability insurance. But what are your options, and what do you need to know?

Coverage Options

There are several different types of auto insurance coverage, each of which provides different levels of protection. The most common types of coverage include:

Liability insurance: This is the minimum coverage required by law in most states. It covers damages and injuries to others in an accident, up to the limits of your policy.

Uninsured and underinsured motorist coverage: This coverage protects you in case you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

Collision coverage: This coverage pays for repairs or replacements to your own vehicle if you’re in an accident, regardless of fault.

Comprehensive coverage: This coverage provides coverage for damage or loss to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

Personal injury protection (PIP): This coverage covers medical expenses, lost wages, and other costs related to injuries you or your passengers sustain in an accident, regardless of fault.

Legal Requirements

The legal requirements for auto insurance vary from state to state. In most states, you are required to carry at least liability insurance. However, some states have additional requirements, such as:

No-fault insurance: In no-fault states, drivers are required to carry insurance that covers their own damages and injuries, regardless of who caused the accident.

Financial responsibility laws: In some states, drivers are required to prove that they can pay for damages and injuries in the event of an accident, even if they don’t have insurance. This can be done by posting a bond or by providing proof of insurance.

How to Choose the Right Coverage

The best way to choose the right auto insurance coverage is to talk to an insurance agent. They can help you assess your needs and recommend the coverage that’s right for you.

Key Takeaways:

- Liability insurance is required by law in most states.

- Uninsured and underinsured motorist coverage protects you in case you’re in an accident with a driver who doesn’t have insurance.

- Collision coverage pays for repairs or replacements to your own vehicle if you’re in an accident.

- Comprehensive coverage provides coverage for damage or loss to your vehicle from events other than collisions.

- Personal injury protection (PIP) covers medical expenses, lost wages, and other costs related to injuries you or your passengers sustain in an accident.

5 Key Types of Car Insurance – CNBC

Homeowners insurance: Protection for your home and belongings

Whether you’re a first-time homeowner or a seasoned property owner, safeguarding your home and belongings with the right insurance is paramount. With numerous home insurance policies available, navigating the options can be daunting. Let’s unravel the world of homeowners insurance to help you make an informed choice that meets your unique needs.

HO Policies: Understanding the Coverage Spectrum

Homeowners insurance policies are categorized as HO-1 to HO-14, each tailored to specific coverage levels and home types. The most common policy for homeowners is the HO-3, providing comprehensive coverage for your home’s structure, personal belongings, and liability protection.

For renters, HO-4 policies offer similar protection for their personal belongings and liability, while HO-6 policies are designed for condo owners, covering both the interior of your unit and shared common areas.

HO-3 vs. HO-5: Enhanced Coverage Options

While HO-3 policies provide a solid foundation of coverage, HO-5 policies offer more comprehensive protection. They cover your belongings on a replacement cost basis, ensuring you receive the full amount needed to replace lost or damaged items with new ones of comparable quality.

Tailoring Your Coverage: Additional Options

Beyond the standard coverage, you can customize your policy with optional endorsements or riders. These can extend protection to valuable items like jewelry, provide coverage for specific events like earthquakes or floods, or increase your liability limits.

Key Takeaways:

- Home insurance policies are categorized as HO-1 to HO-14, offering varying coverage levels and home types.

- HO-3 policies are the most common for homeowners, providing comprehensive coverage.

- HO-5 policies offer enhanced coverage, including replacement cost for personal belongings.

- Optional endorsements or riders can tailor your policy to meet specific needs.

Disability insurance: Income protection in case of disability

Disability insurance: Income protection in case of disability provides a financial safety net if you’re unable to work due to a disability. It replaces a portion of your income, helping you cover essential expenses like mortgage payments, groceries, and medical bills.

Types of disability insurance

There are two main types of disability insurance:

- Short-term disability insurance provides benefits for a limited period, typically up to six months. It’s designed to cover temporary disabilities, such as a broken bone or a pregnancy.

- Long-term disability insurance provides benefits for a longer period, typically up to five years or until you reach retirement age. It’s designed to cover more severe disabilities, such as a stroke or a heart attack.

Benefits of disability insurance

There are many benefits to having disability insurance, including:

- Peace of mind: Knowing that you’ll have a source of income if you’re unable to work can provide peace of mind.

- Financial security: Disability insurance can help you maintain your standard of living and meet your financial obligations if you’re unable to work.

- Protection for your family: If you’re the primary breadwinner in your family, disability insurance can help protect your family from financial hardship if you’re unable to work.

How to choose disability insurance

There are a few things to consider when choosing disability insurance, including:

- The amount of coverage you need: You’ll want to choose a policy that provides enough coverage to meet your financial needs if you’re unable to work.

- The length of the benefit period: You’ll need to choose a policy that provides benefits for the length of time you’re likely to be disabled.

- The elimination period: This is the waiting period before benefits begin. You’ll want to choose a policy with an elimination period that fits your financial needs.

Disability insurance is an important part of a comprehensive financial plan. It can provide you with peace of mind and financial security if you’re unable to work due to a disability.

Key Takeaways:

- Disability insurance provides income protection if you’re unable to work due to a disability.

- There are two main types of disability insurance: short-term and long-term.

- The benefits of disability insurance include peace of mind, financial security, and protection for your family.

- When choosing disability insurance, consider the amount of coverage you need, the length of the benefit period, and the elimination period.

Source: Understanding Disability Insurance: A Guide to Protecting Your Income

FAQ

Q1: What are the different types of insurance available?

A1: There are numerous types of insurance available, including life, health, property, casualty, liability, and business insurance. Each type provides coverage for specific risks and needs.

Q2: What are the most common types of insurance?

A2: The most common types of insurance are auto, home, health, and life insurance. These policies protect individuals and families from financial burdens related to accidents, medical expenses, property damage, and death.

Q3: What is the difference between liability insurance and collision coverage?

A3: Liability insurance covers damages and injuries caused to others in an accident, while collision coverage pays for repairs or replacements to your own vehicle, regardless of fault.

Q4: What are the benefits of umbrella insurance?

A4: Umbrella insurance extends liability coverage beyond the limits of other policies, providing additional protection against potential financial losses due to lawsuits or accidents.

Q5: What types of income protection insurance are available?

A5: Income protection insurance includes disability insurance, long-term disability insurance, disability overhead insurance, total permanent disability insurance, and workers’ compensation. These policies provide financial support in the event of an injury or disability that affects an individual’s ability to earn income.

- Jerry McSorley’s Post-Divorce Life: New Beginnings - July 16, 2025

- The Rise and Fall of the New Haven Nighthawks: A Minor League Hockey Legacy - July 16, 2025

- Unlock Jerry McSorley’s Career Highlights: Eye Tax Inc.’s Solar Success - July 16, 2025