Decoding Your Winnebago County Property Tax Bill

How Property Taxes are Calculated

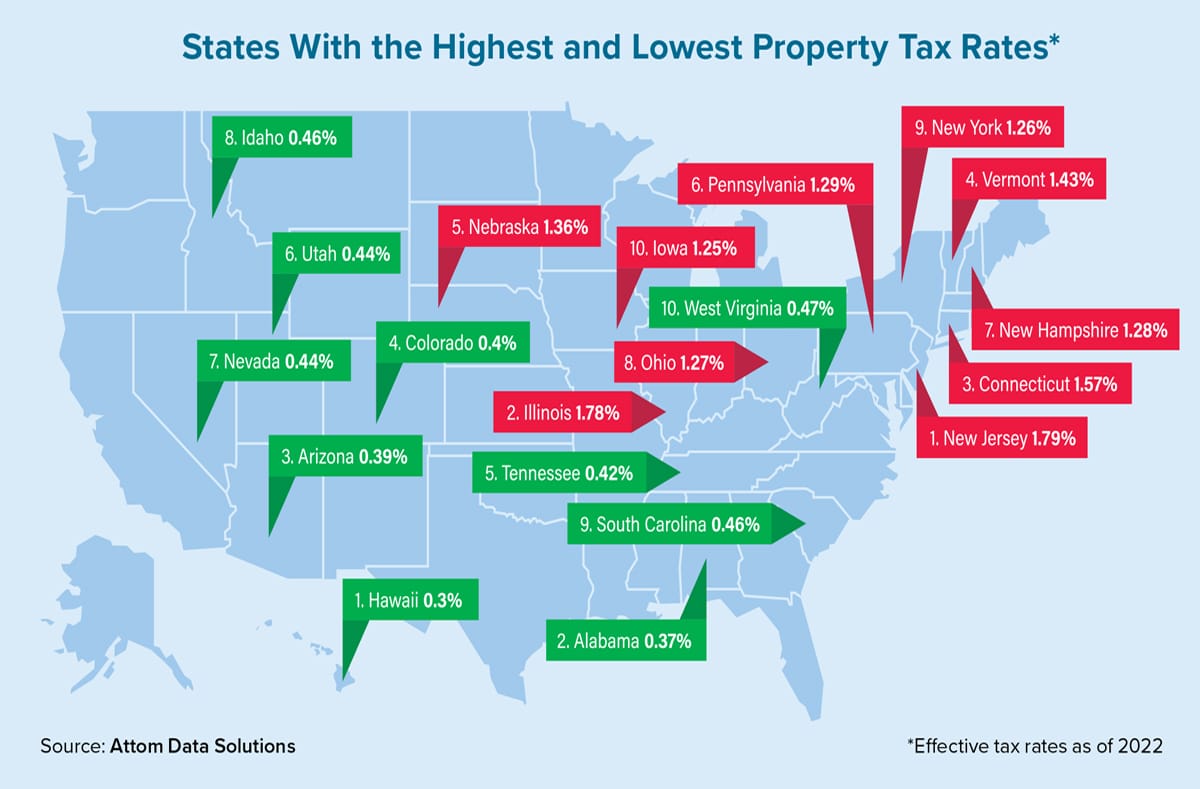

Calculating your Winnebago County property taxes might seem complex, but the basic premise is relatively straightforward. Your property’s assessed value—what the county estimates your property is worth—is multiplied by the local tax rate. While the median effective tax rate in Winnebago County hovers around 2.39%, resulting in a median annual tax bill of approximately $3,056 based on a median home value of $128,100, your individual rate can vary significantly depending on your property’s location and the specific mix of over 100 taxing districts (schools, parks, libraries, etc.) that serve your area. A property in Rockford, for instance, probably has a different tax bill than a comparable property in Loves Park due to variations in services and funding needs. For a more precise understanding, the Winnebago County Assessor determines your property’s fair market value – what they believe your property would sell for in typical conditions. This value, combined with the applicable tax rates from all impacting taxing districts, determines your final Winnebago County property tax bill.

Accessing Your Tax Information Online

Managing your Winnebago County property taxes is easier than ever with a suite of online resources. The Winnebago County Treasurer’s website (taxes.wincoil.gov) acts as your digital hub, providing access to current and past tax bills dating back to 2003. This online portal also allows you to conveniently check your payment status. For a comprehensive view of your property’s assessment history and how its value has changed over time, visit the Supervisor of Assessments’ website.

Payment Methods: Flexibility and Convenience

Winnebago County provides several convenient payment options to settle your property taxes:

- Online: Pay securely via e-check (free) or debit/credit card (2.29% convenience fee processed by Autoagent) through the Treasurer’s online portal at taxes.wincoil.gov. Note: back taxes cannot currently be paid online.

- In Person: Pay at the Winnebago County Treasurer’s Office (check their website for address and hours) or at participating local financial institutions. Contact your bank to confirm their participation and accepted payment types. In-person debit/credit card payments at the Treasurer’s Office incur a small convenience fee.

- By Mail: Send a check or money order (never cash) with your tax statement stub, ensuring it’s postmarked by the due date to avoid penalties. Find the mailing address on the county website or contact the Treasurer’s office.

- Mortgage Escrow: Many homeowners pay their property taxes through their mortgage escrow account. Verify with your lender that the correct amount is being paid to avoid potential shortfalls.

Lowering Your Tax Burden: Exemptions and Appeals

Explore potential savings through property tax exemptions. The Rockford Township Assessor’s Office offers valuable information on various exemptions, including those for senior citizens, veterans, and individuals with disabilities. A key exemption is the General Homestead Exemption for owner-occupied homes, which lowers the taxable value of your primary residence, potentially saving hundreds annually. Remember, rental properties typically don’t qualify unless you complete the annual renewal process. If you believe your assessment is too high even after applying exemptions, you can appeal through the Assessor’s office. While the process might seem daunting, it can lead to a lower assessment.

Mobile Home Taxes: Specific Information

Mobile home owners in Winnebago County are also responsible for property taxes. The Treasurer’s website offers a dedicated section with resources and information tailored to mobile home owners. Tax bills are usually mailed approximately 60 days before the due date.

Stay Informed: Essential Resources

Staying up-to-date on Winnebago County property taxes is crucial. Utilize the Treasurer’s website for timely updates on deadlines, payment options, and any changes in regulations. For specific questions or concerns, contacting the relevant offices directly is always recommended.

| Resource | What You’ll Find |

|---|---|

| Winnebago County Treasurer | General tax information, payment options, deadlines, mobile home tax specifics |

| Supervisor of Assessments | Detailed parcel information, including assessment history, helping you understand your property’s valuation |

| Tax Payment Portal | Secure online tax payment platform, easy access to current and past bills |

| Rockford Township Assessor | Information on potential tax exemptions and the appeals process, offering avenues for potential savings |

Navigating Winnebago County Property Tax Rates

While the frequently cited average property tax rate in Winnebago County may, might suggest around 2.6%, the reality is far more nuanced. Because over 100 taxing districts exist within the county, including schools, parks, and various special service areas, each with its own levy, there isn’t a single, uniform rate. Some experts believe your property’s location within these districts significantly influences your final tax bill. This complex system results in combined rates that vary considerably between properties, even those with similar assessed values.

The County Clerk plays a crucial role in determining these rates. They calculate individual tax rates for each property based on its location and the overlapping taxing districts that serve it. This intricate process, coupled with fluctuating market conditions and unique property characteristics, makes it challenging to predict your exact tax bill before it’s issued. While the median figures—$3,056 annual tax based on a median home value of $128,100—offer a general overview, your specific rate may differ.

Don’t overlook the potential benefit of homestead exemptions, especially the General Homestead Exemption, potentially saving you hundreds. This exemption reduces the taxable value of your primary residence and can significantly offset your tax burden. For specific details and eligibility requirements, contact the County Assessor.

Paying your taxes is straightforward, with online payment via the Winnebago County Treasurer’s website offering a convenient option. Other methods include payments at participating financial institutions, which offers localized convenience. Remember always to contact the Winnebago County Clerk’s office at 815-319-4253 for information regarding past-due or delinquent taxes.

Paying Your Winnebago County Property Taxes: A Step-by-Step Guide

This section provides a detailed walkthrough of each payment method:

Online Payments (taxes.wincoil.gov):

- Visit taxes.wincoil.gov.

- Enter your Parcel Identification Number (PIN).

- Select your payment method: e-Check (no fee) or debit/credit card (2.29% convenience fee).

- Follow the prompts to complete your payment.

Note: Back taxes (2022 and prior) cannot be paid online.

In-Person Payments:

- Winnebago County Treasurer’s Office: (Insert address and hours here – research required). Accepted payment methods typically include cash, check, debit, and credit cards (convenience fees might apply). Having your tax statement or stubs can expedite the process.

- Local Banks: (Research and list participating banks and their accepted payment methods here).

Payment by Mail:

- Make your check or money order payable to the Winnebago County Treasurer (never send cash).

- Include your tax statement stub.

- Mail your payment to: (Insert mailing address here – research required)

Ensure your payment is postmarked by the end of the month to avoid penalties.

Mortgage Escrow Payments:

Confirm with your mortgage lender that your escrow payments cover your full property tax amount and address any discrepancies promptly.

Delinquent Tax Payments (2022 and prior):

Contact the Winnebago County Clerk’s Office directly at 815-319-4253 for specific instructions on paying back taxes. Online payment options are not currently available for back taxes. Remember that back taxes are often assigned to a third party who will add a percentage rate to recover profit margins on their investment, so contact the clerk’s office for redemption amounts.

Accessing Parcel Information:

Visit taxes.wincoil.gov and enter your PIN to access your current and historical parcel tax data (including mobile home information) dating back to 2003.

Discover the hidden gems and captivating history of Wilkeson Washington. Explore the unique desert landscapes and rich cultural heritage of Winkelman AZ.

- Unlock Water’s Symbolism: A Cross-Cultural Exploration - April 20, 2025

- Identify Black and White Snakes: Venomous or Harmless? - April 20, 2025

- Unlocking Potential: Origins High School’s NYC Story - April 20, 2025