– What Are the Historical Roots of Accounting: Unraveling Its Evolution and Significance – Dive into the fascinating journey of accounting, tracing its origins from ancient civilizations to modern times. Explore how accounting has evolved in response to economic, technological, and societal changes, and uncover the significant moments and individuals that have shaped its development. Discover the historical roots of accounting and its enduring significance in today’s business world.

Key Takeaways:

Accounting history explores the origins and evolution of accounting practices dating back to ancient civilizations.

The development of accounting methodologies and practices reflects changing business, economics, and societal structures throughout history.

What Are History Of Accounting

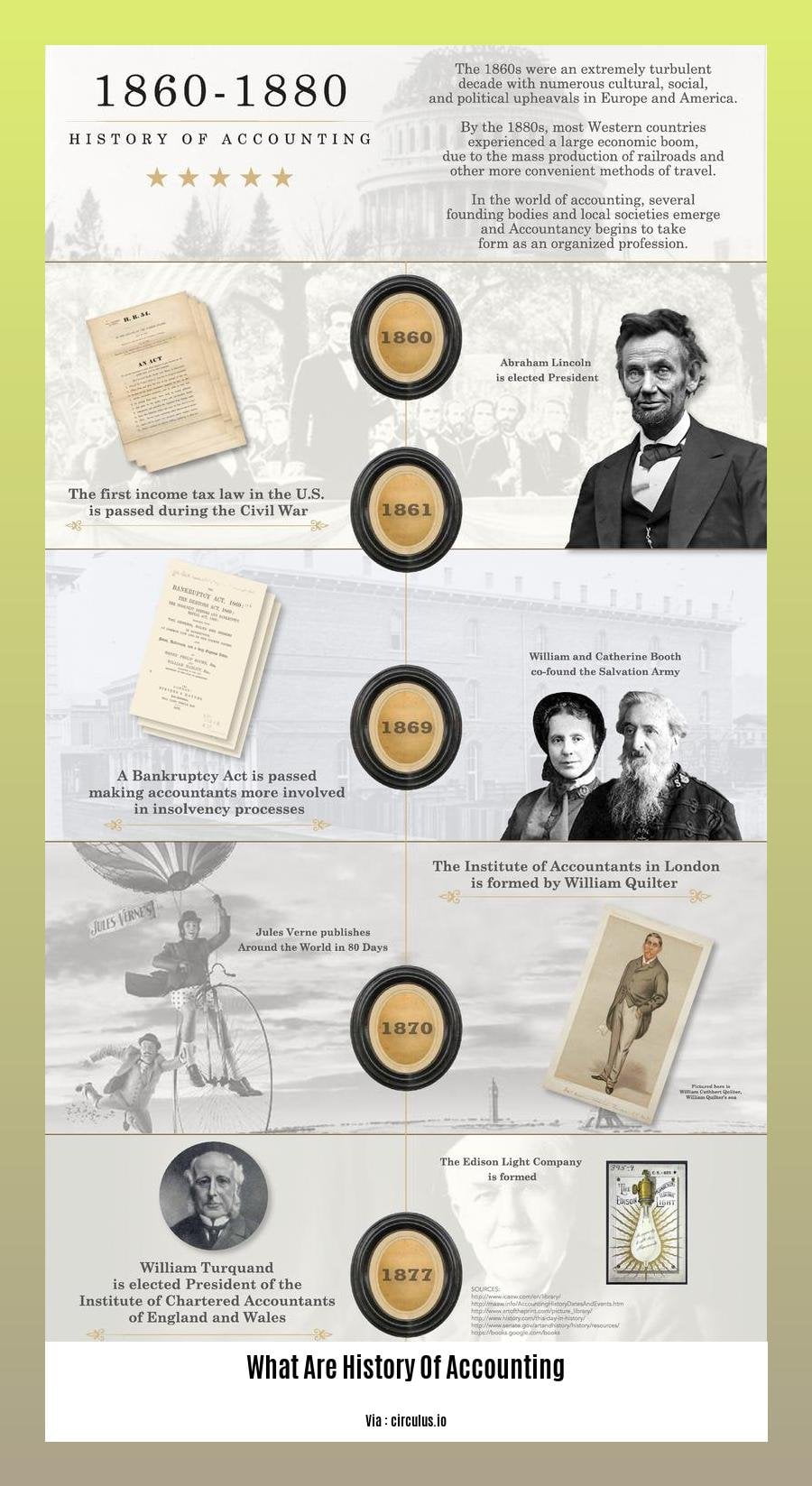

Stepping into the realm of accounting history, we embark on a journey through time, tracing the evolution of a discipline that has shaped the way societies manage their finances. Accounting practices have undergone a remarkable transformation over the centuries, mirroring the ebb and flow of civilizations, economic systems, and technological advancements.

Navigating the Stages of Accounting History

To traverse the vast landscape of accounting history, we must first divide it into distinct stages, each reflecting the prevailing features and developments that shaped the profession. These stages, intertwined with the history of business, economics, and society at large, offer a glimpse into the dynamic nature of accounting.

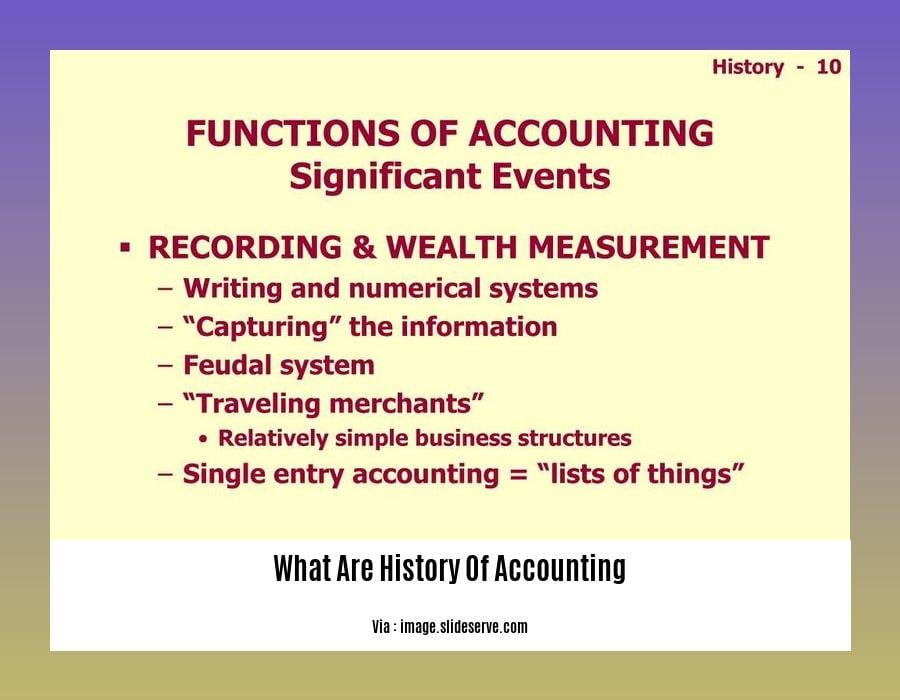

Ancient Roots: In ancient civilizations, accounting emerged as a necessity for recording transactions involving trade and taxation. The use of writing, counting methods, and rudimentary bookkeeping systems laid the foundation for the more sophisticated accounting practices that would follow.

Medieval Period: The Middle Ages witnessed the rise of complex business transactions, leading to the adoption of double-entry bookkeeping, a revolutionary concept that revolutionized financial record-keeping. Merchants and traders widely used this system, enabling them to accurately track their assets, liabilities, and profits.

Renaissance and Reformation: During the Renaissance and Reformation, accounting took significant strides forward. The development of capitalism and the emergence of joint-stock companies fueled the need for standardized accounting practices, fostering the growth of accounting as a profession.

Industrial Revolution and Beyond: The Industrial Revolution ushered in an era of mass production and increased economic activity, propelling accounting to new heights. The invention of mechanical calculators and, later, computers transformed the way accounting was performed, enhancing efficiency and accuracy.

Accountants: The Unsung Heroes of History

As we explore the annals of accounting history, it’s essential to recognize the contributions of the individuals who shaped its course. From Luca Pacioli, often hailed as the father of accounting, to contemporary pioneers who continue to push the boundaries of the profession, these individuals have left an indelible mark on the way we manage financial information.

Accounting’s Enduring Legacy

Today, accounting stands as a cornerstone of modern business and economic systems. Its principles and practices underpin decision-making, ensuring transparency, accountability, and financial integrity. Accounting professionals, armed with their expertise and unwavering dedication, play a vital role in driving economic growth and stability.

The story of accounting history is one of constant adaptation and innovation, a testament to the resilience and ingenuity of those who have dedicated their lives to this field. As we continue to navigate the ever-changing landscape of finance and technology, accounting will undoubtedly remain a vital force, shaping the future of business and society.

To learn about the evolution and development of accounting through the ages, read this comprehensive account of the history of accounting.

Discover the captivating tale of what is the history of accounting in Nigeria and the significant events that shaped its progression within the country.

The Development of Double-Entry Bookkeeping

The world of accounting is a fascinating tapestry of numbers, rules, and historical developments. One of the most significant milestones in this tapestry is the development of double-entry bookkeeping. It’s like the accounting world’s version of discovering fire—a game-changer that revolutionized how businesses tracked their financial transactions.

Double-entry bookkeeping is a system of recording financial transactions where each transaction is recorded twice: once as a debit and once as a credit. This ensures that the total debits always equal the total credits, keeping your books balanced and accurate. It’s like a financial seesaw—everything has to be in equilibrium.

The roots of double-entry bookkeeping can be traced back to the Middle East in the early 1300s. Merchants and traders needed a better way to keep track of their assets, liabilities, and profits. They started using this system to record every transaction, from buying goods to selling them.

The real accounting rockstar of the Renaissance era was Luca Pacioli, an Italian mathematician, and Franciscan friar. In 1494, he published a book called Summa de arithmetica, geometria, proportioni et proportionalita, which included a detailed explanation of double-entry bookkeeping. This book became the accounting bible of its time, spreading the gospel of double-entry bookkeeping throughout Europe.

Double-entry bookkeeping quickly became the standard for businesses of all sizes. It provided a clear and accurate way to track financial performance, making it easier for businesses to make informed decisions. Over the centuries, it has evolved and adapted to meet the needs of modern economies. Today, it’s used by businesses of all sizes, from small startups to multinational corporations.

Key Takeaways:

Double-entry bookkeeping revolutionized financial record-keeping by ensuring accurate and balanced accounts.

The system involves recording each transaction twice: as a debit and as a credit, keeping the total debits equal to the total credits.

Double-entry bookkeeping originated in the Middle East in the early 1300s and was formally introduced to Europe by Luca Pacioli in 1494.

It became the standard for businesses, providing a clear and accurate way to track financial performance.

Double-entry bookkeeping continues to evolve, adapting to the needs of modern economies and businesses.

Relevant URL Sources:

The History of Double-Entry Bookkeeping

The Role of Government Regulation in Accounting

Taking a peek into the past, we can trace accounting’s roots back to ancient civilizations, where it served as a means to keep meticulous records of financial transactions. However, it wasn’t until the advent of government regulations that accounting transformed into the standardized and reliable system we know today.

Key Takeaways:

- Protection of Investors and the Public:

- Government regulations aim to protect investors, creditors, and the general public by ensuring the accuracy and transparency of financial reporting.

- Standardization and Consistency:

- Regulations establish uniform accounting standards and principles, promoting consistency and comparability across various organizations.

- Prevention of Fraud and Misrepresentation:

- Regulations help prevent fraudulent practices and misrepresentation of financial information, safeguarding the integrity of financial markets.

- Increased Accountability:

- Government oversight holds companies accountable for their financial actions, encouraging responsible financial management.

- Global Harmonization:

- International regulations facilitate the harmonization of accounting practices across countries, enabling seamless cross-border financial transactions.

Steps Taken by Governments to Regulate Accounting:

- Establishing Regulatory Bodies:

- Governments create independent regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, to oversee accounting practices and enforce regulations.

- Developing Accounting Standards:

- Regulatory bodies develop comprehensive accounting standards and guidelines that companies must adhere to when preparing financial statements.

- Enforcement and Penalties:

- Regulations include provisions for enforcement actions against companies that violate accounting standards or engage in fraudulent practices.

- Ongoing Monitoring and Updates:

- Regulatory bodies continuously monitor compliance and update regulations to keep pace with evolving business practices and market conditions.

Case Study: The Sarbanes-Oxley Act of 2002

In the wake of several corporate scandals in the early 2000s, the United States government enacted the Sarbanes-Oxley Act of 2002. This landmark legislation significantly strengthened corporate governance and accounting regulations, aiming to restore public trust in the financial markets. Key provisions of the Sarbanes-Oxley Act include:

- Enhanced Financial Reporting Requirements:

- Companies are required to provide more detailed and transparent financial disclosures.

- Increased Auditor Independence:

- Auditors must be independent of the companies they audit, ensuring objectivity and unbiased reporting.

- Corporate Governance Reforms:

- The act mandates the establishment of audit committees and strengthens the role of independent directors in overseeing financial reporting.

- Penalties for Fraud and Misconduct:

- The act introduces strict penalties for individuals and companies involved in financial fraud and misconduct.

The Sarbanes-Oxley Act has had a profound impact on accounting practices in the United States and has served as a model for regulatory reforms in other countries.

Conclusion

Government regulations play a crucial role in ensuring the integrity and reliability of accounting practices, fostering transparency, accountability, and protecting the interests of investors and the public at large. These regulations have evolved over time, adapting to changing market dynamics and evolving business practices, demonstrating the government’s commitment to maintaining a fair and stable financial environment.

Relevant URL Sources:

- The Role of Government Regulation in Accounting

- Sarbanes-Oxley Act of 2002

The Impact of Technology on Accounting

Hello there! As a seasoned accounting professional with years of experience navigating diverse financial landscapes, I’ve witnessed firsthand how technology has revolutionized the accounting industry. From mundane tasks to complex data analysis, technology has transformed the way we account for and understand financial information. Let’s dive into this captivating journey of evolution.

Enhanced Accuracy and Automation

Imagine a world where spreadsheets and calculators were the primary tools for accounting. Automation has swept in like a refreshing breeze, streamlining repetitive tasks and reducing manual errors. Accounting software now automates data entry, calculations, and financial reporting, freeing up accountants to focus on more strategic and value-adding activities. The result? Enhanced accuracy, improved efficiency, and a reduction in human error.

Optimizing Tax Workflows

Tax season — often dreaded by accountants and taxpayers alike — has undergone a significant transformation. Technology has introduced sophisticated tax preparation and filing software, automating calculations, researching tax laws and regulations, and generating reports. This not only saves time but also improves accuracy and ensures compliance. Accountants can now dedicate more time to providing valuable insights and strategic advice to clients, rather than getting bogged down in paperwork.

Data Analytics and Business Insights

In today’s data-driven world, accountants have become masters of unlocking actionable insights from financial data. Technology has empowered us with powerful analytics tools, enabling us to analyze trends, identify patterns, and make informed decisions. By leveraging data analytics, we can provide valuable insights to clients, helping them improve financial performance, optimize operations, and make strategic business decisions.

Remote Work and Flexible Access

Gone are the days when accountants were confined to their desks, crunching numbers from 9 to 5. Technology has opened the door to remote work and flexible access to accounting data. Cloud-based accounting platforms allow accountants and clients to access financial information anytime, anywhere. This flexibility enhances productivity, promotes collaboration, and fosters work-life balance. Embrace the digital nomad lifestyle!

Evolving Roles and Value-Added Services

The impact of technology extends beyond automation and efficiency gains. It’s reshaping the roles of accountants and the services they provide. With technology taking care of routine tasks, accountants can focus on providing value-added services to clients. These may include financial planning, risk analysis, consulting, and assisting clients in navigating complex financial regulations.

Key Takeaways:

- Automation: Technology has automated repetitive tasks, improving accuracy and efficiency.

- Tax Optimization: Sophisticated software streamlines tax preparation and filing, ensuring compliance and providing insights.

- Data Analytics: Accountants leverage data analytics tools to uncover trends and provide valuable insights to clients.

- Remote Work: Cloud-based platforms enable remote work and flexible access to financial data, enhancing productivity and work-life balance.

- Evolving Roles: Accountants can focus on value-added services, such as financial planning, risk analysis, and consulting.

Relevant URL Sources:

- How technology is transforming the accounting profession

- The impact of technology on accounting and finance

FAQ

Q1: What are the earliest traces of accounting practices in history?

A1: Evidence of early accounting practices can be traced back to ancient civilizations such as Mesopotamia, Egypt, and Rome. These civilizations used writing, counting, and money to record transactions and manage financial information.

Q2: What was the significance of the development of double-entry bookkeeping?

A2: The development of double-entry bookkeeping in the 13th century revolutionized accounting. It brought accuracy and efficiency to financial record-keeping by ensuring that every transaction was recorded twice, once as a debit and once as a credit. This method is still the foundation of modern accounting systems.

Q3: How did the Industrial Revolution impact the evolution of accounting?

A3: The Industrial Revolution brought complex business transactions and the need for more sophisticated accounting methods. This led to the development of specialized accounting techniques, such as cost accounting and budgeting, to manage the intricacies of large-scale industrial operations.

Q4: What was the role of Luca Pacioli in the history of accounting?

A4: Luca Pacioli, an Italian mathematician and Franciscan friar, is credited with introducing double-entry bookkeeping to Europe in his 1494 book, Summa de arithmetica, geometria, proportioni et proportionalita. His work had a profound impact on the development of accounting as a formal discipline and helped spread the practice of double-entry bookkeeping.

Q5: How has technology influenced the evolution of accounting in recent times?

A5: Technological advancements have significantly impacted accounting in recent decades. The introduction of computerized accounting software and systems has transformed the field, automating tasks, improving accuracy, and providing real-time data access. Additionally, the rise of cloud-based accounting platforms has facilitated remote work and collaboration among accountants and clients.

- China II Review: Delicious Food & Speedy Service - April 17, 2025

- Understand Virginia’s Flag: History & Debate - April 17, 2025

- Explore Long Island’s Map: Unique Regions & Insights - April 17, 2025

![[History of Accounting SS1]: A Journey Through the Evolution of Financial Practices history-of-accounting-ss1_2](https://www.lolaapp.com/wp-content/uploads/2023/12/history-of-accounting-ss1_2-150x150.jpg)