This guide provides a comprehensive overview of the Statute of Frauds as it applies to real estate transactions, helping you navigate this crucial legal aspect with confidence.

Understanding the Statute of Frauds

The Statute of Frauds is a critical legal concept designed to protect you during real estate transactions. It mandates that certain agreements, particularly those involving real estate, must be in writing and signed to be legally enforceable. This safeguards both buyers and sellers from misunderstandings and potential disputes. Think of it as a safety net, ensuring everyone is on the same page and preventing issues later on. If you want to learn more about sample subordination clause, click the link.

Key Requirements of the Statute of Frauds

The Statute of Frauds has specific requirements that must be met for a real estate contract to be valid. These include:

Put It in Writing

Verbal real estate agreements, while they might feel binding, are extremely difficult to enforce. A written contract offers tangible proof of the agreement, protecting both parties involved.

Sign on the Dotted Line

All parties must sign the written contract for it to be legally valid. Missing signatures can significantly weaken the contract and potentially render it unenforceable.

Details Matter

A comprehensive contract, encompassing all essential details of the transaction, is crucial. This should include the precise property address, purchase price, closing date, and any other relevant conditions. The more detailed the contract, the less chance for future disagreements.

State-Specific Rules

While the underlying principle of the Statute of Frauds is similar across the U.S., specific requirements can differ between states. Consult with a legal professional to understand the specific laws in your jurisdiction.

Consequences of Ignoring the Statute of Frauds

Disregarding the Statute of Frauds can lead to significant problems. Verbal agreements are generally unenforceable, potentially causing financial loss or jeopardizing property rights. Imagine a seller backing out after you’ve made financial commitments. Without a written contract, your legal recourse may be limited.

Seeking Expert Legal Counsel

Navigating real estate law can be challenging. Consulting with a real estate attorney is highly recommended, especially if you have questions or concerns about the Statute of Frauds. A lawyer can help you understand state-specific laws, ensure your contract is legally sound, and guide you through the process, protecting your interests.

Key Points of the Statute of Frauds for Real Estate

- Written Contract: Essential for enforceability.

- Signatures: All parties must sign.

- Details: Include all essential information (address, price, date, conditions).

- State-Specific Rules: Requirements vary by state.

- Consequences of Non-Compliance: Unenforceable agreements, potential losses.

- Expert Help: Consult a real estate attorney.

Texas Real Estate Contracts: Navigating the Statute of Frauds

The Statute of Frauds plays a vital role in Texas real estate transactions, providing essential legal protection for buyers and sellers. Understanding this law is crucial for a smooth and legally sound transaction.

Texas Statute of Frauds: A Deep Dive

In Texas, the Statute of Frauds dictates that real estate contracts must be in writing to be enforceable. This falls under Chapter 26 of the Texas Business and Commerce Code. A verbal agreement, regardless of how well-intentioned, will not hold up in court.

Essential Elements of a Texas Real Estate Contract

A valid written contract in Texas must include:

- Identification of Parties: Full legal names of buyer and seller.

- Property Description: Precise legal description (lot and block numbers, metes and bounds), not just the street address.

- Purchase Price: Clearly stated and agreed upon amount.

- Signatures: Both buyer and seller must sign.

Consequences of Non-Compliance in Texas

A contract lacking these elements is probably unenforceable, potentially allowing either party to withdraw without penalty. Imagine believing you’ve purchased your dream home, only to have the deal collapse due to a flawed contract.

Consulting with a Texas Real Estate Attorney

It’s highly recommended to have an attorney review any contract before signing. They can ensure compliance with the Statute of Frauds, protecting your interests and providing peace of mind. While it might seem like an extra cost, it can prevent expensive disputes later.

Texas Statute of Frauds: Key Takeaways

- Written contracts are mandatory for enforceability in Texas.

- The contract must include specific identification of parties, detailed property description, purchase price, and signatures.

- Non-compliant contracts are likely unenforceable.

- Consulting a real estate attorney is strongly advised.

- In Texas, real estate contracts fall under the Statute of Frauds (Texas Business and Commerce Code, Chapter 26), requiring them to be in writing to be enforceable.

- A valid written real estate contract in Texas must clearly identify the parties, property description, essential terms (price, closing date), and signatures of all parties.

- Exceptions to the Texas Statute of Frauds in real estate are limited, focusing primarily on partial performance and promissory estoppel, requiring strong evidence.

- Failing to comply with the Statute of Frauds can render a Texas real estate contract unenforceable, leading to potential financial losses and legal disputes.

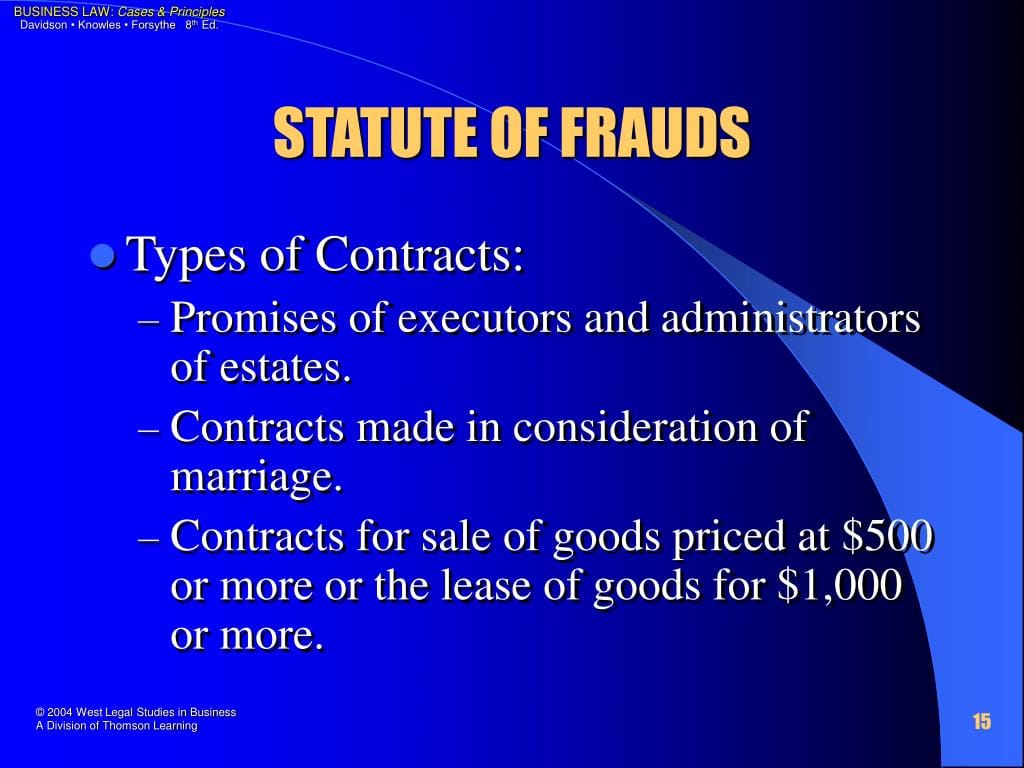

Understanding the UCC Statute of Frauds

The UCC (Uniform Commercial Code) Statute of Frauds provides guidelines for contracts involving the sale or lease of goods, ensuring clarity and protection for all parties.

Transactions Covered by the UCC Statute of Frauds

The UCC Statute of Frauds primarily governs:

- Buying and Selling Goods: Contracts for goods worth $500 or more likely require a written contract, although a simple email or text specifying quantity can sometimes suffice.

- Leasing Goods: Similar rules apply to leases where total payments exceed $500. A written record detailing the lease terms is essential.

Exceptions to the UCC Statute of Frauds

While a written contract is generally required, some exceptions exist:

- Custom-Made Goods: A written contract may not be necessary if the goods are custom-made and the seller has begun production or procured materials.

- Partial Performance: If one party has started fulfilling the agreement (e.g., payment or delivery), this might enforce the agreement even without a full written contract.

- Admission in Court: A party’s admission in court of making an agreement can be binding, but only for the admitted quantity.

- Merchant Confirmations: An oral agreement between merchants, confirmed in writing by one party and not objected to by the other within 10 days, probably creates a binding contract.

Importance of the UCC Statute of Frauds

The UCC Statute of Frauds offers several benefits:

- Fraud Prevention: It hinders false claims of agreements.

- Clarity of Terms: Written contracts minimize misunderstandings.

- Enforcement: A written contract provides solid evidence for legal enforcement.

The Evolving Nature of Commercial Law

It’s important to acknowledge that commercial law is dynamic. Ongoing research and discussions may suggest new perspectives, and some experts believe parts of the Statute of Frauds might need updating for the digital age. The interpretation of electronic communications fulfilling the “writing” requirement is still being debated. Therefore, while the fundamental principles remain relevant, specific interpretations may evolve.

Seeking Professional Advice

Given the complexities of the UCC Statute of Frauds, consulting a legal professional for advice on specific contracts is always recommended.

The One-Year Rule and the Statute of Frauds

The one-year rule, a component of the Statute of Frauds, dictates that contracts impossible to complete within one year must be in writing to be enforceable.

Understanding the One-Year Rule Test

The crucial question is not whether a contract is likely to take over a year, but whether it’s possible to complete it within a year. Even a remote possibility of completion within a year exempts the contract from the one-year rule.

Examples

- Building a skyscraper: While likely to take years, it’s theoretically possible to finish within a year, thus the one-year rule probably doesn’t apply.

- Two-Year Landscaping Service: Impossible to complete within a year; the one-year rule applies, requiring a written contract.

Applying the Possibility Test

The one-year rule hinges on possibility, not probability. If a scenario exists where the contract could be fully executed within a year, the one-year rule doesn’t apply. However, written contracts are always advisable, even if not legally required.

Nuances and Legal Counsel

Legal interpretations can vary, and ongoing discussion exists regarding the subtleties of the one-year rule. Consulting a legal professional for advice on specific contracts is always recommended.

One-Year Rule: Key Takeaways

- Focuses on the possibility of completion within one year.

- Not about the probability or likelihood of completion timeframe.

- If completion within one year is theoretically possible, the rule doesn’t apply.

- Legal counsel is recommended for specific contract situations.

- The One-Year Rule Test: A contract falls under the Statute of Frauds if it’s impossible to fully perform within one year from the date the contract is made, not merely unlikely or difficult.

- Possibility Test: Even a slim chance of completion within one year exempts a contract from the Statute of Frauds’ writing requirement, making verbal agreements potentially enforceable.

- State-Specific Variations: While the one-year rule is generally consistent, specific state laws may have unique interpretations or exceptions, necessitating careful review.

- Beyond One Year: The Statute of Frauds covers other contract types (land sales, goods over $500), so even if the one-year rule doesn’t apply, other provisions might.

By understanding the Statute of Frauds and its various components, including the one-year rule and UCC provisions, you can better protect yourself in real estate and commercial transactions. Remember, consulting with a legal professional is always a wise decision when dealing with complex legal matters.

- Unlock Water’s Symbolism: A Cross-Cultural Exploration - April 20, 2025

- Identify Black and White Snakes: Venomous or Harmless? - April 20, 2025

- Unlocking Potential: Origins High School’s NYC Story - April 20, 2025

1 thought on “The Statute of Frauds in Real Estate: What You Absolutely Need to Know”

Comments are closed.