Subordination clauses are essential components of both grammar and legal agreements. This guide provides a clear explanation of what they are, how they function, and their implications in various contexts. We’ll explore different types of subordination clauses, offer practical examples, and delve into the nuances of their legal applications, particularly in real estate and finance. Navigate these crucial concepts with confidence using our comprehensive guide.

Deciphering Subordination Clauses

Subordination clauses dictate priority: They determine which debts get paid first in situations like foreclosure or bankruptcy, safeguarding lenders’ interests. More than just grammar, subordination clauses in legal contracts define the hierarchy of financial obligations, impacting everything from mortgages to business loans.

A subordination clause, within a larger contract (often called a subordination agreement), establishes the priority of debt repayment. It designates one debt as “senior” or “superior” and another as “junior” or “subordinated.” This clause does not forgive the junior debt; it simply establishes payment order. While grammatically, a subordinate clause is a dependent clause needing an independent clause, legally, it’s a critical part of a contract defining financial priorities.

How Subordination Works: Senior vs. Junior Debt

Imagine a line of creditors waiting to be paid. The subordination clause establishes who’s at the front of the line (senior debt) and who’s further back (junior debt). The purpose is to protect lenders by ensuring they recoup their investment before other creditors in case of default.

For instance, if John has a first mortgage (senior debt) and a second mortgage (junior debt) and defaults, the first mortgage lender gets paid from the sale proceeds before the second mortgage lender. This same priority is enforced during bankruptcy proceedings. A subordination clause typically identifies the senior and subordinated debts, stating the priority clearly, and may include conditions triggering the subordination.

Types of Subordination Agreements

There are two main types of subordination agreements, each affecting when the priority takes effect:

- Automatic Subordination: Priority is established immediately upon signing the agreement.

- Conditional Subordination: Priority is contingent upon a specific event, such as the completion of a project or achieving a financial milestone.

Practical Application: Real-World Examples

Subordination clauses are frequently used in several financial scenarios:

- Real Estate: Common in second mortgages, where the second lender accepts a subordinate position to the first mortgage.

- Refinancing: When refinancing a primary mortgage, the new loan typically requires a subordination agreement from any existing second mortgage holder.

- Corporate Finance: Utilized in complex lending structures involving multiple creditors.

- Leases: A lease can be subordinated to a mortgage, giving the mortgage lender priority over the tenant’s rights in case of foreclosure. This could mean a tenant would need to move out if the property is foreclosed on, even if their lease isn’t up. Avoid verbal agreements that may lead to real estate disputes. Instead, create a binding contract in writing to protect your interests in accordance with the statute of frauds for real estate.

Sample Subordination Clause (Lease)

Here’s a simplified example from Law Insider, illustrating how subordination might appear in a lease agreement:

“20.1 This Lease shall be subject and subordinate at all times to the lien of any mortgage or deed of trust…which may now or which may at any time hereafter be made upon the Project…or upon Landlord’s interest therein.”

Additional Examples

- Homeowner Refinancing: A homeowner with a first and second mortgage refinances the first mortgage. The new first mortgage lender will require a subordination agreement from the second mortgage holder to maintain their senior position.

- Business Loan: A company secures a loan using equipment as collateral. A subsequent lender providing a working capital loan might agree to subordinate their loan to the equipment loan. This could mean that if the company defaults, the lender who financed the equipment gets the equipment before the working capital lender gets any remaining funds.

Negotiating Subordination and Associated Risks

Subordination isn’t always straightforward. The negotiation process involves factors influencing a lender’s willingness to subordinate their debt. The junior lender, by accepting subordination, takes on a greater risk of not being paid in full. Sometimes, a junior lender might accept this risk in exchange for a higher interest rate. This added risk is why a thorough understanding of subordination clauses is essential.

Alternatives to subordination include intercreditor agreements, which outline the rights and obligations of multiple creditors in a more comprehensive manner. Further research is recommended to fully comprehend the nuances of intercreditor agreements versus subordination. Subordination can also influence interest rates on the different loans. The increased risk for the junior lender may lead to a higher interest rate, while the reduced risk for the senior lender could lead to a slightly lower rate. It’s important to remember that subordination agreements can have varying implications depending on state-specific regulations. Legal counsel specialized in financial agreements can help navigate these complexities.

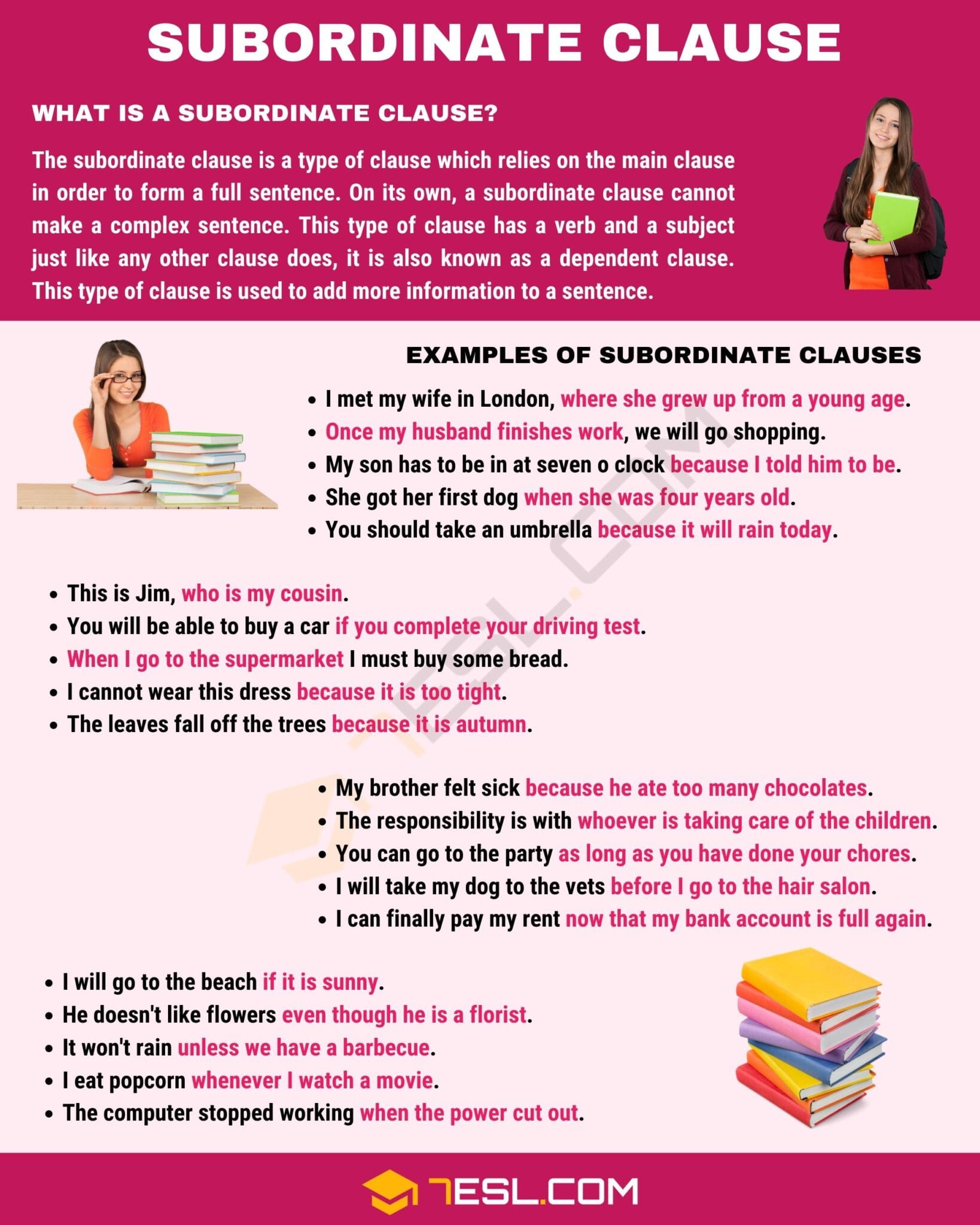

Writing Subordinate Clauses: A Grammar Refresher

Shifting from the legal context, let’s revisit subordination clauses in grammar. These clauses, also known as dependent clauses, cannot stand alone as a complete sentence. They require an independent clause to form a complete thought. They’re like supporting actors, adding depth and context to the main clause (the star).

Subordinate clauses usually begin with subordinating conjunctions (e.g., because, although, since, if, while, when) or relative pronouns (e.g., who, whom, which, that, whose). These words signal the clause’s dependence on the main clause. The three main types of subordinate clauses mirror parts of speech:

Noun Clauses: These function as nouns, serving as subjects, objects, or complements. Example: “What I want for dinner is pizza.”

Adjective Clauses: These modify nouns, providing additional details. Example: “The book that I read last week was fantastic.”

Adverb Clauses: These modify verbs, adjectives, or other adverbs, explaining when, where, why, or how something happened. Example: “She went to the store because she needed milk.”

Constructing a subordinate clause is straightforward: Begin with a subordinating word, add a subject and verb, and finally connect the clause to the independent clause, often with a comma, especially if the subordinate clause comes first. Punctuation can be nuanced; essential clauses may not require a comma, while nonessential clauses typically do.

Conclusion: Mastering Subordination for Clarity and Protection

Subordination clauses are powerful tools in both legal and grammatical contexts. In legal agreements, they establish clear hierarchies of debt, protecting lenders and offering borrowers access to multiple financing options. In grammar, they provide detail and nuance, enriching sentence structure and enhancing communication. Understanding these clauses is crucial for anyone involved in financial transactions or striving for clear, effective writing. While this guide provides a comprehensive overview, consulting with legal professionals is always recommended when dealing with complex financial agreements. Ongoing research continues to explore the evolving applications of subordination clauses in different financial instruments, suggesting the potential for even greater flexibility for both borrowers and lenders in the future.

- Star Ring Trends: Etsy vs Amazon - March 28, 2025

- Boost Pollinator Habitats: Baby Blue Eyes Sustainable Farming Guide - March 28, 2025

- Protect Big Black Bears: Effective Conservation Strategies - March 28, 2025