Getting bombarded with calls from PFS LLC? Confused about who they are and why they’re calling? This comprehensive guide breaks down everything you need to know about handling calls from PFS LLC (Progressive Financial Services or Phoenix Financial Services), empowering you to take control and protect your rights.

Decoding PFS LLC: Who Are They and Why Are They Calling?

Receiving calls from unknown numbers can be unsettling, especially if it’s a debt collector. This section helps you understand PFS LLC and their potential reasons for contacting you.

Who is PFS LLC?

PFS LLC likely refers to either Progressive Financial Services or Phoenix Financial Services, both operating as debt collection agencies. Debt collection agencies act as intermediaries between creditors (the original lenders) and debtors (those who owe money). PFS is tasked with recovering overdue payments for various debts, ranging from credit cards and student loans to medical bills and utility charges.

Why Might PFS LLC Be Contacting You?

Several scenarios could explain why PFS LLC might be calling:

- Legitimate Debt: The most probable reason is that PFS believes you owe a debt to one of their clients.

- Mistaken Identity: Administrative errors, similar names, or even identity theft can lead to debt collectors contacting the wrong person.

- Administrative Error: Mistakes happen. Sometimes, debts are incorrectly assigned or information is misreported, causing unwarranted collection calls.

- Old Debts Resurfacing: Even debts thought to be settled or forgotten can resurface if sold to a new collection agency. plagiocephaly in adults

- Debt Sold to Collection Agency: Your original creditor may have sold your debt to a collection agency, which explains the unfamiliar caller.

- Scams: While less common, scammers sometimes pose as debt collectors to trick people into paying non-existent debts. shidduch alerts

What to Do When PFS LLC Calls: A Step-by-Step Guide

Don’t panic. Having a plan can significantly reduce stress and empower you to handle these calls effectively.

Step 1: Respond Cautiously (or Not at All)

You are not obligated to answer every call. If you’re unprepared or feeling overwhelmed, let it go to voicemail. If you choose to answer, remain calm and avoid providing personal information until you’ve verified the caller’s identity and the reason for the call. A simple “How can I help you?” is a good starting point.

Step 2: Verify the Debt and the Caller

Don’t take their word for it. Politely but firmly request verification of the debt in writing. This is your right under the Fair Debt Collection Practices Act (FDCPA). The debt validation letter must include:

- The amount of the alleged debt

- The name of the original creditor

- An explanation of your rights under the FDCPA

Also, verify the caller’s identity. Ask for their name, company name, address, phone number, and the name of the original creditor. Cross-reference this information with online resources or the Better Business Bureau to confirm their legitimacy.

Step 3: Contact the Original Creditor

Reach out to the company or institution that originally issued the debt. This step helps confirm whether the debt is legitimately yours and if it’s been sold to a collection agency. This allows you to get the full picture directly from the source.

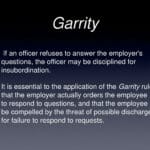

Step 4: Know Your Rights Under the FDCPA

The FDCPA is a federal law designed to protect you from abusive, unfair, and deceptive debt collection practices. Key protections include:

- Protection from Harassment and Threats: Debt collectors cannot use abusive language, threaten violence, or make false statements.

- Restrictions on Calling Times: They generally can’t call before 8 a.m. or after 9 p.m. your local time.

- Right to Debt Validation: You have the right to request written verification of the debt.

- Right to Dispute the Debt: If you believe the debt is not yours, you have the right to dispute it.

- Right to Cease Communication: You can send a cease and desist letter to stop further communication (with certain legal exceptions).

Step 5: Document Everything

Maintain a meticulous record of every interaction with PFS LLC. Note the date and time of each call, the name of the person you spoke with, and a summary of the conversation. Keep copies of any letters or emails you receive. This documentation is invaluable if you need to dispute the debt, report harassment, or seek legal counsel.

How to Stop the Calls from PFS LLC: Effective Strategies

Several options exist for stopping unwanted communication from PFS LLC:

1. Negotiate a Payment Plan

If you verify the debt and are financially capable, negotiating a payment plan with PFS might be a viable solution. This could involve reducing the monthly payments or settling for a smaller lump sum.

2. Dispute the Debt

If you believe the debt is not yours, is inaccurate, or you have already paid it, dispute it in writing with both PFS LLC and the three major credit reporting bureaus (Equifax, Experian, and TransUnion).

3. Send a Cease and Desist Letter

This formal letter informs PFS LLC to stop all communication with you. While it doesn’t erase the debt, it should stop collection calls, except for legally required notifications (like a lawsuit).

(Sample Cease and Desist Letter – Customize for your specific situation)

“`

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

Phoenix Financial Services, LLC / Progressive Financial Services, LLC

[PFS Address]

Re: Account Number [Your Account Number, if known]

This letter formally requests that you cease all communication with me regarding the above-referenced account, pursuant to the Fair Debt Collection Practices Act (FDCPA).

I dispute this debt and request validation in writing, including the amount owed, the original creditor, and documentation proving my responsibility.

Further communication, including phone calls, letters, emails, or any other form of contact, will be considered a violation of the FDCPA.

Sincerely,

[Your Signature]

[Your Typed Name]

“`

Where to Get More Help: Valuable Resources

Several organizations offer assistance and guidance in dealing with debt collection:

- Consumer Financial Protection Bureau (CFPB): consumerfinance.gov The CFPB protects consumers from unfair, deceptive, and abusive practices in the financial industry.

- Your State Attorney General’s Office: Contact your state’s Attorney General for consumer complaints and potential legal assistance.

- Credit Counseling Services: Non-profit credit counseling agencies can provide guidance on budgeting, debt management, and improving your overall financial situation.

By understanding your rights and taking proactive steps, you can effectively manage calls from PFS LLC and regain control. Remember, knowledge is power. Don’t let them intimidate you. You’ve got this!

2 thoughts on “PFS LLC Calling You? Stop the Harassment: Your Rights & How to Deal With Progressive & Phoenix Financial”

Comments are closed.