Investing wisely requires more than just gut feelings; it demands solid data-driven decisions. While the Internal Rate of Return (IRR) is a common tool, it can sometimes present an overly optimistic view. This is where the Modified Internal Rate of Return (MIRR) comes in, offering a more realistic perspective on investment potential. This comprehensive guide provides a step-by-step approach to understanding and utilizing the MIRR calculator, empowering you to make smarter financial choices.

Understanding the MIRR

What is MIRR?

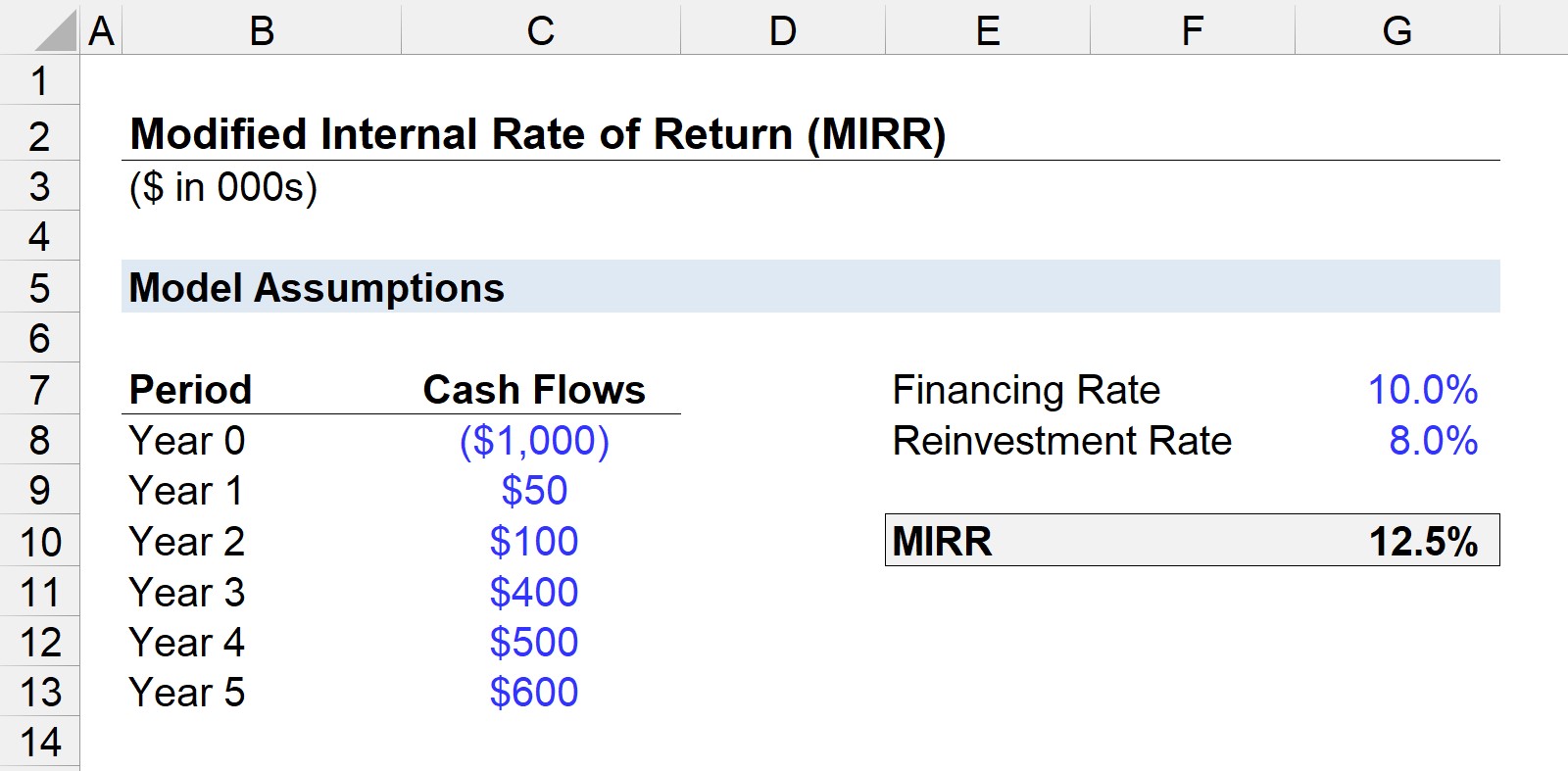

The MIRR represents a more refined approach to evaluating investment returns, especially when dealing with uneven cash flows. Unlike the traditional IRR, which assumes reinvestment of profits at the project’s initial return rate, MIRR allows for separate rates for borrowing (finance rate) and reinvesting profits (reinvestment rate). This nuance provides a more accurate reflection of real-world investment scenarios, where reinvestment opportunities may vary.

Why is MIRR Important?

The primary advantage of MIRR lies in its ability to address the potentially unrealistic reinvestment rate assumption of the IRR. By incorporating distinct finance and reinvestment rates, MIRR offers a more accurate and nuanced assessment of an investment’s profitability. This is particularly crucial when comparing projects with different cash flow patterns or when evaluating projects in fluctuating market conditions. Some experts believe that MIRR provides a more accurate reflection of investment performance than IRR.

Calculating MIRR: A Step-by-Step Guide

Manual Calculation (The Formula Approach)

Calculating MIRR manually involves a few key steps:

-

Future Value (FV) of Positive Cash Flows: Calculate the future value of all positive cash flows at the reinvestment rate. This represents the total value of reinvested profits at the end of the investment period.

-

Present Value (PV) of Negative Cash Flows: Calculate the present value of all negative cash flows at the finance rate. This represents the current cost of the investment, considering the cost of capital.

-

Applying the MIRR Formula: The MIRR formula combines these values:

MIRR = (FV of positive cash flows / PV of negative cash flows)^(1/n) - 1

Where ‘n’ is the total number of periods (typically years) of the investment.

Utilizing Calculators and Excel

Fortunately, manual calculations aren’t always necessary. Several tools simplify the process:

-

Online MIRR Calculators: Numerous websites offer free MIRR calculators. Simply input the initial investment, cash flows for each period, the finance rate, and the reinvestment rate. The calculator then outputs the MIRR.

-

Microsoft Excel: Excel’s

=MIRR()function streamlines the calculation. Enter the cash flows (including the initial negative investment) in a range of cells. Then, use the formula=MIRR(values, finance_rate, reinvest_rate), where “values” is the cell range containing the cash flows. -

Financial Calculators: Many financial calculators (like the BA II Plus, TI-84, and Casio FX-991ES PLUS) offer built-in MIRR functions. Consult your calculator’s manual for specific instructions, as the process may vary slightly among models. The process usually involves clearing previous entries, inputting cash flows (with negative signs for outflows), setting the finance and reinvestment rates, and then computing the MIRR. For more detailed instructions on using specific financial calculators, see our guides: How to calculate MIRR on a financial calculator? and How to calculate MIRR on Casio calculator?.

MIRR vs. IRR: A Comparative Analysis

| Feature | MIRR | IRR |

|---|---|---|

| Reinvestment Rate | User-defined (more realistic) | Assumed equal to the IRR (potentially unrealistic) |

| Multiple Solutions | Avoids the possibility | Can occur with irregular cash flows |

| Accuracy | More realistic | Can overestimate profitability |

While both metrics assess investment potential, MIRR provides a more nuanced and likely more accurate perspective, especially in situations where reinvestment rates differ from the project’s IRR.

Practical Applications of MIRR

Capital Budgeting

Businesses use MIRR to compare potential projects and prioritize those with the highest MIRR, leading to more effective resource allocation.

Investment Analysis

Investors use MIRR to assess the potential returns of individual investments under different reinvestment scenarios, providing a more comprehensive understanding of potential outcomes.

Portfolio Management

MIRR enhances portfolio optimization by identifying investments with superior risk-adjusted returns, improving overall portfolio performance.

Sensitivity Analysis and Limitations

It’s crucial to remember that MIRR relies on assumptions about future rates, which can fluctuate. Performing sensitivity analysis by adjusting the finance and reinvestment rates helps gauge the impact of these changes on the MIRR, providing a more robust evaluation. Ongoing research suggests that while MIRR offers valuable insights, it’s not a perfect predictor. The financial landscape is complex, and MIRR, like any metric, has its limitations. Using it in conjunction with other financial tools, like Net Present Value (NPV), provides a more holistic view.

Conclusion

The MIRR offers a valuable tool for investment decision-making, moving beyond the limitations of traditional IRR calculations. By incorporating realistic reinvestment assumptions, MIRR provides a more accurate and nuanced measure of profitability. Whether using online calculators, Excel, or financial calculators, understanding and applying MIRR empowers you to navigate the complexities of finance with greater confidence and make smarter investment choices.

For more information on specific financial topics, explore resources such as Milburn Stone Net Worth and Money6x Com Earning.

- Unveiling Bernhard Caesar Einstein’s Scientific Achievements: A Legacy in Engineering - July 15, 2025

- Uncover who is Jerry McSorley: CEO, Family Man, Business Success Story - July 15, 2025

- Discover Bernhard Caesar Einstein’s Scientific Contributions: Unveiling a Legacy Beyond Einstein - July 15, 2025

3 thoughts on “Mastering the MIRR Calculator: A Comprehensive Guide with Examples and Excel Calculations”

Comments are closed.