Navigating today’s market can feel like charting a course through turbulent waters. Understanding the underlying currents—economic indicators, geopolitical events, and investor sentiment—is crucial. Joseph Adinolfi, a seasoned MarketWatch reporter with over a decade of experience covering markets, acts as our compass, providing expert analysis to help investors make sense of the complexities. This in-depth profile explores Adinolfi’s latest insights on stocks, bonds, and the economy, delving into his predictions and placing them within the broader market context.

Decoding the Market with Joseph Adinolfi

Joseph Adinolfi is more than just a reporter; he’s a market analyst who connects the dots between seemingly disparate events. His experience, spanning traditional finance at MarketWatch and the alternative perspectives of Zero Hedge, provides a balanced lens through which he examines market dynamics. Adinolfi doesn’t just tell you what’s happening; he explains why. This ability to provide context and interpretation is invaluable in today’s volatile environment. He analyzes everything from stock market trends and economic indicators to the potential impact of the Federal Reserve’s policies ([https://www.lolaapp.com/kevin-hassett-economist] offers further insights into the Fed’s role).

Adinolfi’s Background and Expertise

With over 10 years covering markets, economics, crypto, and even politics, Adinolfi brings a wealth of experience to his analysis. His work has been featured in prominent financial publications like MarketWatch, Morningstar, MSN, and Yahoo Finance, demonstrating the reach and impact of his insights. You can find his latest analyses regularly on MarketWatch and track his contributions through platforms like Muck Rack. For those seeking direct engagement, his professional profiles on LinkedIn and Intelligent Relations provide further avenues for connection. He can also be reached at [email protected].

Why Adinolfi’s Insights Matter

In a world awash with financial data, Adinolfi’s analysis cuts through the noise, providing actionable intelligence. He distills complex information into digestible insights, empowering investors to make more informed decisions. He doesn’t shy away from complex topics like the yen carry trade or the “Great Rotation,” offering nuanced perspectives that go beyond surface-level reporting.

Key Market Predictions and Analyses

Adinolfi’s recent coverage provides a timely snapshot of current market dynamics, offering both warnings and potential opportunities.

The Yen Carry Trade: A Brewing Storm?

Adinolfi’s recent analysis of the yen carry trade suggests a potential market risk. Traders betting against the Japanese yen might face significant losses if the currency strengthens unexpectedly. This could trigger a ripple effect across global markets, highlighting the interconnected nature of the financial world.

Treasuries: A Contrarian View

While long-term U.S. Treasury bonds have faced headwinds, Adinolfi points to a contrarian view suggesting a tactical buying opportunity. Some analysts believe the bearish sentiment is overdone, presenting a potential for gains for those willing to go against the prevailing market sentiment.

Tech and AI: Navigating the Hype

Amidst the fervor surrounding artificial intelligence, Adinolfi examines the potential for a tech bubble. He explores whether current valuations are justified or if we’re witnessing another instance of market exuberance. His analysis encourages investors to approach the AI sector with cautious optimism.

The “Great Rotation” and Investor Sentiment

Adinolfi has been closely following the “Great Rotation,” a shift in investor allocations from bonds to stocks. He also examines investor sentiment heading into 2024, providing valuable insights into the collective mindset of the market.

Actionable Insights for Investors

Adinolfi’s analysis offers practical guidance for navigating the current market landscape.

Economic Indicators as Your Compass

Understanding key economic metrics like GDP, inflation, and interest rates is essential. Adinolfi expertly interprets these indicators, helping investors anticipate potential market movements.

Data-Driven Decision Making

Adinolfi’s analysis transforms raw data into actionable intelligence. He leverages data and insights from platforms like the London Stock Exchange Group ([LSEG]), helping investors uncover hidden opportunities and manage risk effectively.

The Interplay of Politics and Markets

Adinolfi recognizes the significant impact of political events on markets. His analysis of the political landscape provides crucial context, allowing investors to anticipate potential market reactions.

Choosing the Right Investment Platform

Adinolfi offers guidance on selecting investment platforms, considering factors such as fees, investment choices, and ease of use. Whether it’s an established platform like Hargreaves Lansdown or a newer entrant like eToro, his insights help investors find the right fit for their individual needs. Remember, investing involves risk. Platforms like Hargreaves Lansdown (“Capital at Risk”) and Plus500 (“80% of retail CFD accounts lose money”) clearly state these risks. Adinolfi’s analysis empowers investors to navigate these risks with greater awareness.

| Feature | Hargreaves Lansdown | eToro |

|---|---|---|

| Account Types | ISAs, SIPPs, Fund & Share Accounts | Retail investor, Professional Client |

| Fees | Varies based on account and investments | Commission-free stocks, varies for other assets |

| Investment Choices | Wide range of funds, shares, bonds, ETFs | Stocks, ETFs, Cryptocurrencies, Copy Trading |

| Best For | Long-term investors, retirement planning | Beginners, active traders, crypto enthusiasts |

Disclaimer: It is important to always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. The insights provided here are for educational purposes and should not be construed as financial advice.

Addressing the “Lost Decade” Paradox

One of the most intriguing aspects of Adinolfi’s recent analysis is the apparent contradiction between a two-year bull market and the whispers of a potential “lost decade” for stocks. While the market has seen significant rallies, underlying concerns about rising interest rates, persistent inflation, and geopolitical tensions persist. Even prominent firms like Goldman Sachs have expressed caution. This disconnect between current performance and long-term forecasts highlights the importance of nuanced analysis and a balanced perspective. While short-term gains are possible, investors should be prepared for potential periods of stagnation or decline. Some experts suggest that while the current market may appear strong, structural weaknesses could lead to an extended period of underperformance.

A Balanced Perspective

While Adinolfi’s insights provide valuable context and interpretation, it’s crucial to remember that markets are inherently unpredictable. Expert opinions should be viewed as one piece of a larger puzzle. Diversification, thorough research, and an understanding of your own risk tolerance remain essential elements of sound investment strategy. You can explore further insights from other influential figures in finance, such as Jennifer Niccol, to gain a more comprehensive understanding of the market landscape. By combining expert analysis with your own due diligence, you can navigate the complexities of the financial world with greater confidence.

- Unlock Elemental 2 Secrets: Actionable Insights Now - April 2, 2025

- Lot’s Wife’s Name: Unveiling the Mystery of Sodom’s Fall - April 2, 2025

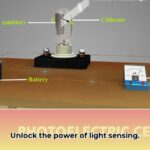

- Photocell Sensors: A Complete Guide for Selection and Implementation - April 2, 2025