Taxes can be complicated, especially when it comes to retirement and education savings. This guide simplifies IRS Form 5329, helping you navigate potential penalties and keep your hard-earned money where it belongs. Whether you’ve withdrawn funds early, over-contributed, or missed a required distribution, understanding this form can save you money and stress.

Decoding Form 5329

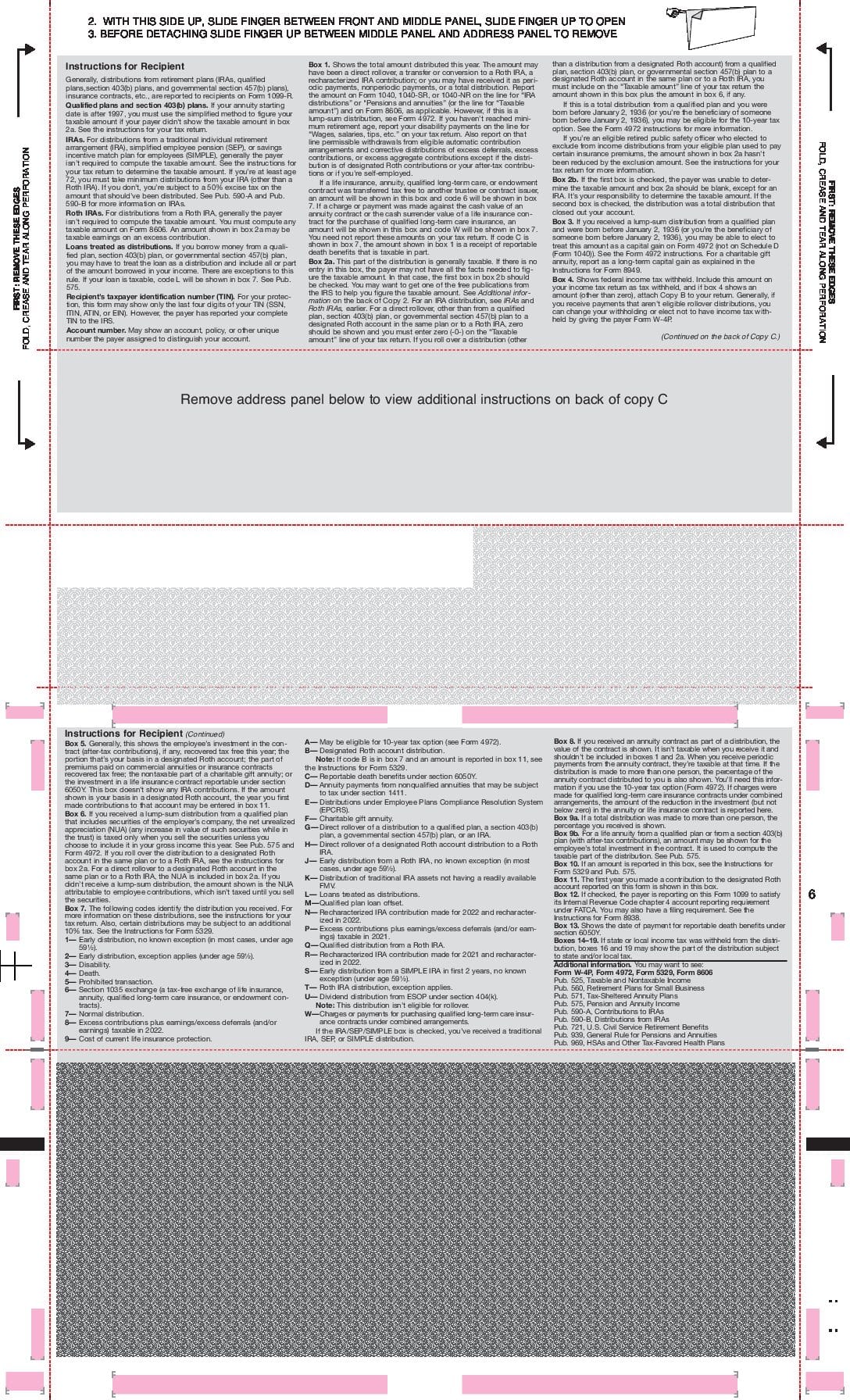

Form 5329 helps you calculate and report additional taxes on tax-advantaged accounts like IRAs, 401(k)s, and HSAs. These taxes can arise from various situations, and this form ensures you’re paying the correct amount, no more, no less.

Do You Need to File?

You’ll likely need Form 5329 if any of these apply:

- Early withdrawals from retirement savings.

- Excess contributions to retirement or education accounts.

- Missed Required Minimum Distributions (RMDs).

When and How to File

File Form 5329 alongside your annual tax return (Form 1040, 1040-SR, 1040-NR, or 1041) by the tax deadline, usually mid-April. You can file electronically or by mail.

Navigating the Form

Form 5329 is divided into sections. Fill out only the parts relevant to your situation:

| Part | Description |

|---|---|

| I | Additional Tax on Early Distributions |

| III | Additional Tax on Excess Contributions to Traditional IRAs |

| IV | Additional Tax on Excess Contributions to Roth IRAs |

| V | Additional Tax on Excess Contributions to Coverdell ESAs |

| VI | Additional Tax on Excess Contributions to Archer MSAs |

| VII | Additional Tax on Excess Contributions to HSAs |

| VIII | Additional Tax on Excess Contributions to ABLE Accounts |

| IX | Additional Tax on Excess Accumulation in Qualified Plans (RMDs) |

Understanding Common Penalties

Several penalties can be calculated using Form 5329. Being aware of them helps you plan and avoid surprises:

- Early Withdrawal Penalty: Generally a 10% additional tax on withdrawals from retirement accounts before age 59 ½. Exceptions may apply, so research thoroughly or consult a tax professional.

- Excess Contribution Penalty: A 6% excise tax on excess contributions to retirement accounts, applied annually until the excess is corrected. Staying organized and understanding contribution limits can prevent this.

- Missed RMD Penalty: A substantial penalty, currently 25% (possibly reduced to 10% with timely correction) of the required amount not withdrawn from retirement accounts after reaching the specified age (currently 73). Setting up automatic withdrawals can be a helpful strategy.

Waivers and Exceptions

The IRS may waive penalties under certain circumstances, such as financial hardship or unexpected medical expenses. Research potential exceptions and procedures for requesting a waiver.

Filing Form 5329: A Step-by-Step Guide

- Gather Your Documents: Collect all relevant account statements, tax forms, and supporting documentation.

- Determine Your Filing Needs: Review the instructions and your account information to determine if you need to file Form 5329.

- Complete the Form: Carefully fill out the applicable sections, ensuring accuracy.

- Include Supporting Documents: Attach any documents supporting waiver requests or claimed exceptions.

- File with Your Tax Return: Submit Form 5329 with your tax return by the deadline.

Expert Insights and Tips

- Meticulous Record-Keeping: Maintain detailed records of contributions, withdrawals, and RMDs to simplify tax preparation and avoid potential issues.

- Regular Account Reviews: Periodically check your accounts to monitor balances and prevent excess contributions.

- Professional Advice: Consult a tax professional if you have complex questions or need personalized guidance.

- IRS Resources: Utilize the numerous resources and assistance offered by the IRS.

How to Use Form 5329

Using Form 5329 effectively requires understanding why you’re filing and preparing accordingly. This section clarifies the process.

1. Identify Your Reason for Filing

Determine the specific issue: early withdrawals, excess contributions, non-qualified education expense distributions, or missed RMDs. This focuses your efforts on the relevant sections.

2. Gather Necessary Documents

Assemble your Social Security number, relevant tax year information, and documents related to the distributions or contributions in question.

3. Navigate the Relevant Parts

Focus on the sections pertaining to your specific situation:

- Part I: Early withdrawals from retirement plans.

- Part II: Distributions from education accounts for non-qualified expenses.

- Part III: Excess contributions to Traditional IRAs.

- Part IX: Excess accumulation in retirement plans (missed RMDs).

Key Considerations

- Form 5329 calculates taxes and penalties on specific actions related to your accounts.

- Detailed instructions accompany the form, providing further clarification and examples.

- Maintaining accurate records throughout the year simplifies the process and can help avoid penalties altogether.

- Consult a financial advisor for personalized guidance, particularly for complex situations.

How to Report Excess Contribution Withdrawal

Accidentally over-contributing to your retirement or education savings accounts happens. This guide helps you correct it efficiently.

Step 1: Contact Your Administrator

Inform your plan administrator or financial institution of the over-contribution and your intent to withdraw the excess funds and any earnings.

Step 2: Understand Form 5329

Form 5329 reports excess contributions to the IRS. Work with your administrator to complete the appropriate sections based on your account type.

Step 3: Calculate Taxes and Penalties

Excess contributions may be subject to income tax and a 6% excise tax until corrected. Form 5329 guides these calculations.

Step 4: File with Your Tax Return

Attach Form 5329 to your annual tax return (Form 1040, Schedule 2, Line 8). Even if you don’t typically file a return, file Form 5329 separately if you have excess contributions.

Step 5: Pay What You Owe

Pay any calculated taxes and penalties promptly after filing to avoid further complications.

Important Reminders

- Address over-contributions promptly to minimize penalties.

- Your plan administrator is a valuable resource.

- File Form 5329 with your tax return or separately, as required.

- Consult IRS resources or a tax professional for up-to-date information.

What is the Return of Excess Contributions Form?

Form 5329, the “Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts,” is used to rectify situations like excess contributions, early withdrawals, and missed RMDs, ensuring you’re compliant with IRS regulations.

When Might You Need to File?

Several scenarios necessitate filing Form 5329:

- Excess Contributions: Contributing beyond the yearly limits.

- Early Withdrawals: Accessing retirement funds before age 59 ½ without qualifying for an exception.

- Missed RMDs: Failing to take required minimum distributions after reaching the specified age.

Understanding Form 5329

This form is divided into sections for different account types and penalties. The table below summarizes common penalties and relevant sections:

| Issue | Potential Penalty | Form 5329 Section |

|---|---|---|

| Excess Contributions | 6% excise tax per year | Part I (and other relevant parts) |

| Early Distributions | 10% additional tax (exceptions apply) | Part II |

| Missed RMDs | 50% excise tax (before 2024) | Part III (before 2024) |

| Missed RMDs | 25% excise tax (2024 and later, can be reduced to 10%) | Part VII (2024 and later) |

Promptly addressing these issues is crucial. Proper record-keeping and understanding contribution limits and withdrawal rules can help avoid these situations.

Why These Rules Exist

These rules encourage responsible retirement saving and prevent abuse of tax advantages provided by the government.

Looking Ahead

Tax laws are subject to change. Stay current on IRS updates and seek professional guidance when necessary. Learn more about the fascinating world of figure skating leaps to take a break from the complexities of tax forms. While this information is intended to be helpful, it may not cover every scenario, and exceptions may apply. Consulting with a financial advisor is always recommended for personalized guidance.

- Discover Long Black Pepper: Flavor & Health Benefits - April 25, 2025

- Shocking Twists: The Grownup Review: Unreliable Narration - April 25, 2025

- A Quiet Place Book vs Movie: A Deep Dive - April 25, 2025

1 thought on “Form 5329 Instructions 2023: A Comprehensive Guide to Avoiding Penalties”

Comments are closed.