AMC: From Popcorn to Meme Stock Mania

AMC Entertainment: once synonymous with moviegoing, now evokes the wild world of meme stocks. How did this happen? FintechZoom offers tools and data to help us understand this unusual journey, acting as a financial GPS to navigate the rollercoaster of AMC’s stock price. [https://www.lolaapp.com/emc-documentum]

Decoding the AMC Saga

AMC’s transformation from a traditional cinema chain into a meme stock phenomenon is a fascinating case study. FintechZoom’s platform offers insights into the dramatic price swings and market events that have shaped AMC’s trajectory. It’s a valuable resource for anyone seeking to understand this volatile investment. [https://www.lolaapp.com/em9-guitar-chord]

FintechZoom’s Data Dive

Investing in AMC without FintechZoom’s insights would be like navigating uncharted waters without a compass. The platform offers critical data, including historical price swings and trading volumes. It helps investors understand the forces driving AMC’s price movements, such as retail investor enthusiasm, short squeezes, and broader industry challenges.

AMC’s Place in the Future of Entertainment

The entertainment world is in constant flux, with streaming services transforming how we consume content. FintechZoom can help assess AMC’s position in this evolving landscape. Are strategies like cryptocurrency acceptance enough to navigate these choppy waters? The platform empowers investors to analyze these crucial questions.

AMC’s Financial Health: Beyond the Hype

Beyond the meme stock buzz, what’s the reality of AMC’s financial health? FintechZoom provides valuable insights into the company’s revenue, debt, and key performance indicators. Is AMC on a path to stability or walking a financial tightrope? The platform’s data-driven analysis empowers investors to draw their own conclusions.

Using FintechZoom to Analyze AMC Stock

- Access the Platform: Visit the FintechZoom website.

- Search for AMC: Enter “AMC” or its ticker symbol.

- Explore the Data: Analyze real-time quotes, historical charts, news sentiment, and expert analysis.

- Compare and Contrast: Benchmark AMC against competitors to understand its relative strengths and weaknesses.

| Feature | Benefit |

|---|---|

| Real-Time Quotes | Stay updated with up-to-the-minute AMC stock prices. |

| Historical Charts | Identify trends and potential future price movements. |

| News Sentiment | Gauge the overall market sentiment toward AMC. |

| Expert Analysis | Access perspectives from experienced financial analysts. |

| Competitor Comparison | Contextualize AMC’s performance against other entertainment companies. |

By combining FintechZoom’s tools with an understanding of the entertainment industry, investors can navigate the complexities of AMC stock. Remember, all investments carry risk. FintechZoom provides information, but investment decisions are your own. Conduct thorough research and consult a financial advisor. [https://www.lolaapp.com/dragon-bolts-osrs]

Is AMC Stock a Buy? Analyzing Debt, Revenue, and Meme Stock Impact

AMC Entertainment presents a complex investment proposition. Is it a smart buy? The answer depends on your risk tolerance and investment goals.

Debt Burden

AMC’s substantial debt hinders its ability to invest in improvements and compete with streaming giants. While efforts are being made to manage this debt, it remains a significant concern.

Box Office Struggles and Revenue Diversification

The decline in traditional moviegoing presents a challenge to AMC’s primary revenue source. Diversification efforts, like enhanced concessions and partnerships, are underway, but their effectiveness remains to be seen.

The Meme Stock Rollercoaster

AMC’s meme stock status has led to dramatic price swings. These fluctuations create both opportunities and risks. Be prepared for volatility if considering investing in AMC.

Fintech Zoom and AI: A Tool, Not a Crystal Ball

Fintech Zoom utilizes AI to analyze stock trends, but it’s not a fortune teller. Fundamental factors, like financial health and industry adaptation, are crucial for investment decisions.

Weighing the Risks and Rewards

Investing in AMC is a gamble. Thorough research, financial analysis, and an understanding of your risk tolerance are essential. Some experts suggest focusing on unique theatrical experiences could be key for AMC’s future, while others believe streaming’s dominance will continue to pose a challenge.

AMC Stock: Beyond the Meme Frenzy – A 2024 Outlook

AMC’s stock price, currently around $2.65 (as of April 2024), continues to be volatile. Does AMC stock have a future? The answer is complex and depends on several factors.

Navigating Market Volatility

The meme stock frenzy of 2021 significantly impacted AMC’s stock price, demonstrating the market’s unpredictability. While the frenzy has subsided, volatility persists, reflecting market uncertainties and AMC’s precarious position. Some analysts suggest further decline, while others see potential for resurgence depending on the company’s turnaround strategies.

The Evolving Entertainment Landscape

Can AMC adapt to the streaming-dominated entertainment landscape? This remains a key question. AMC’s efforts to enhance the theatrical experience and explore alternative content will be crucial for its survival. Some experts believe these efforts could differentiate AMC from streaming services, while others suggest a hybrid model incorporating a streaming platform or partnerships might be necessary.

The Weight of Debt

AMC’s substantial debt limits its ability to invest in necessary innovations. This debt burden poses a significant challenge and could hinder its ability to compete effectively.

FintechZoom: A Source of Information?

While various websites reference “FintechZoom,” further research is needed to determine its credibility and the reliability of its analysis. Due diligence is crucial when evaluating online financial information.

The Uncertain Future of AMC

Investing in AMC remains a risky proposition. The company’s future depends on its ability to innovate, manage its debt, and adapt to the changing entertainment landscape. Potential investors should carefully weigh the risks and rewards.

AMC Stock: Who Holds the Power? Unveiling the Biggest Shareholders

Understanding AMC’s ownership structure provides valuable insights into its potential trajectory.

The Heavyweight Champion: Antara Capital LP

Antara Capital LP, a hedge fund, holds approximately 93.91 million shares, representing about 25% ownership. This significant stake gives them considerable influence over company decisions.

Institutional Investors: A Collective Force

Over 416 institutional investors, including giants like Vanguard Group Inc. and SG Americas Securities LLC, collectively own around 36.17% of AMC. Their combined influence is substantial.

The Insiders: A Long-Term Perspective?

Insiders control approximately 58.32% of AMC stock. This raises questions about their focus on long-term growth versus short-term profits.

Retail Investors: Still a Force?

While retail investor ownership has decreased to around 5.51%, their collective action, often fueled by social media, can still significantly impact the stock price.

The Wanda Enigma: Beijing Wanda Culture

The current ownership stake of Beijing Wanda Culture, once a major shareholder, requires further investigation.

Understanding the Dynamics

AMC’s ownership structure is a dynamic interplay of power and influence. Each investor group, from institutional giants to retail investors, plays a role in shaping the company’s future. Regularly consulting updated financial information is crucial for staying informed about these evolving dynamics.

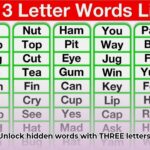

- Unlocking 2-Letter Words with U: The Definitive Guide - April 4, 2025

- Unlock Words with the Letters THREE: Top Unscramble Tools 2025 - April 4, 2025

- Master Scrabble: X & Z Words for High Scores - April 4, 2025