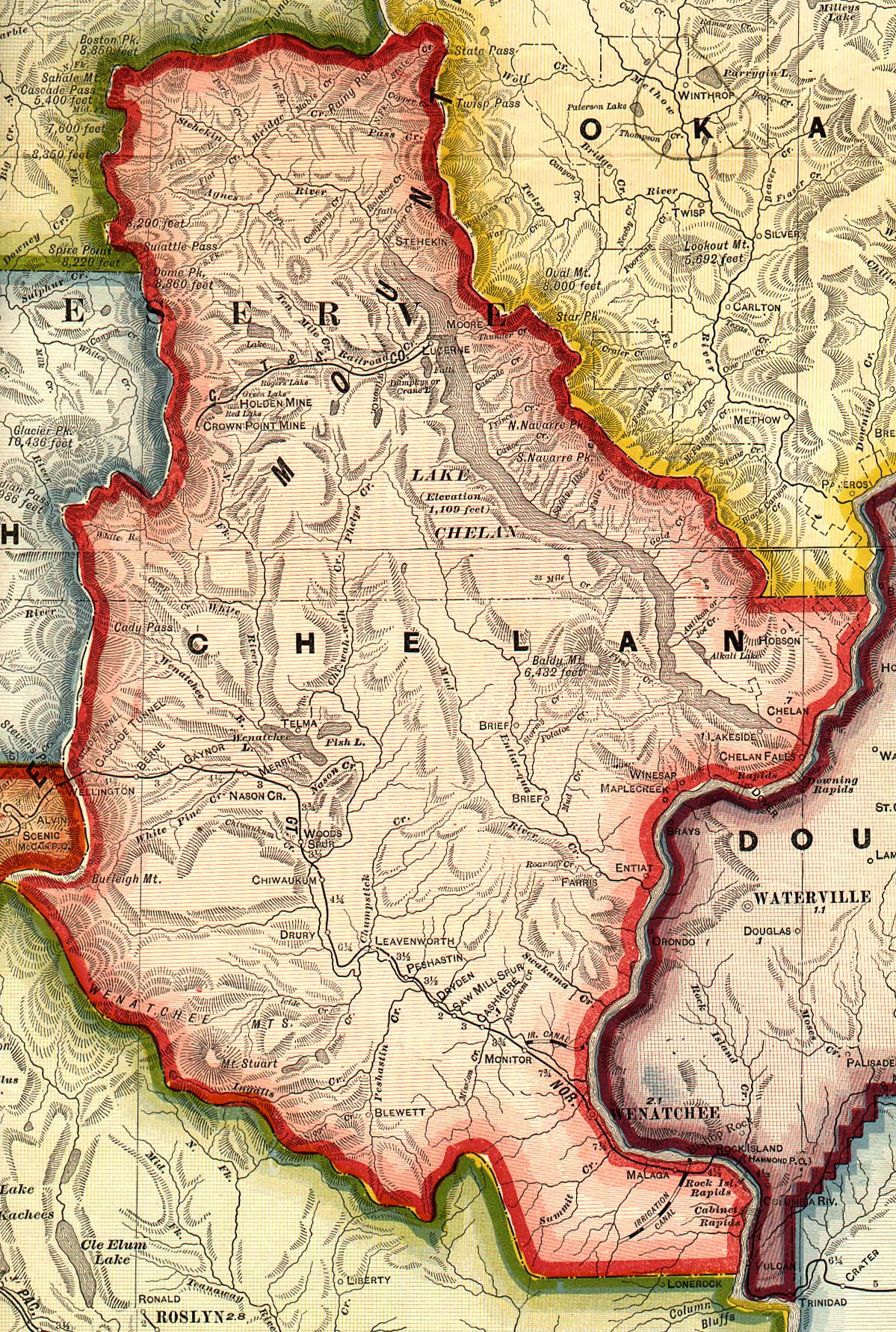

Understanding property taxes can be challenging. This guide provides a clear overview of the Chelan County Assessor’s role, services, and online resources, helping you navigate the property tax process with ease.

Understanding the Assessor’s Role

The Chelan County Assessor is responsible for determining the value of all taxable real and personal property within the county. These valuations directly impact your property tax bill. The Assessor’s office also maintains comprehensive property records, manages exemptions, and facilitates the appeals process for property owners.

Accessing Key Information Online

The Chelan County Assessor offers user-friendly online tools to access property data:

Property Search Portal: This online portal (https://pacs.co.chelan.wa.us/PropertyAccess/?cid=91) allows you to search for property information using various criteria, such as parcel number, owner name, address, or sales data. You can access details like ownership information, assessed value, tax code areas, and sales history.

GIS Mapping: The interactive GIS map (https://www.arcgis.com/home/webmap/viewer.html?webmap=71998d…) provides a visual representation of property boundaries, ownership, and other relevant details. This tool can be particularly helpful for understanding a property’s location and surrounding environment.

Services Offered by the Assessor’s Office

The Chelan County Assessor’s office, situated at 350 Orondo Avenue in Wenatchee (within the County Courthouse), provides a range of services:

Property Valuations: The Assessor determines the market value of properties using various methods, such as comparable sales, cost approach, and income approach (typically for commercial properties).

Appealing Your Assessment: If you disagree with your property’s assessed value, you can file an appeal. The Assessor’s office can guide you through the process and explain the required documentation and deadlines. While the specific exemptions can vary, they often aim to provide tax relief for certain groups or property types.

Property Tax Exemptions: Several exemptions may reduce your property tax burden. These might include exemptions for homeowners (homestead exemptions), seniors, individuals with disabilities, and certain property types. Check with the Assessor’s office for a complete list and eligibility requirements.

Property Tax Information: The Assessor’s office offers resources and support to help you understand your property tax obligations. They can help clarify how taxes are calculated and answer any general questions you may have.

Navigating the Appeals Process

Think your assessment may be inaccurate? You have the right to appeal. The Assessor’s office provides a defined appeals process, and gathering evidence like comparable sales data may strengthen your appeal.

- Process: The steps involved will vary, so contact the Assessor’s office or visit their website for detailed instructions.

- Deadlines: Adhering to deadlines is critical. The Assessor’s office can provide specific dates.

- Documentation: Specific documentation will likely be required. Contact the Assessor’s office for a list of necessary documents.

Exploring Property Tax Exemptions

Property tax exemptions can significantly reduce your tax bill. Research suggests that many property owners might be unaware of exemptions they qualify for. The Assessor’s Office can provide details on eligibility and application procedures. While specific exemptions can change, common ones include:

- Homestead Exemption: Available for owner-occupied primary residences.

- Senior/Disabled Exemptions: Specific exemptions are often offered to senior citizens and individuals with disabilities.

Contacting the Chelan County Assessor

For questions or assistance, contact the Chelan County Assessor:

| Contact Method | Information |

|---|---|

| Address | 350 Orondo Avenue, Wenatchee, WA 98801 |

| Phone | (Insert Phone Number Here) |

| (Insert Email Address Here) | |

| Website | (Insert Website URL Here) |

Data last updated: 11/20/2024 3:28 AM

Discover the captivating history and hidden gems of Conemaugh Township. Explore the unique charm and vibrant community of Coolspring Township Indiana.

Additional Insights:

- Assessments and property values can fluctuate due to market conditions and other factors. Ongoing research explores how these variables affect valuations.

- While the Assessor’s office aims for accuracy, variations in valuation methods can occur. The appeals process provides a mechanism for addressing potential discrepancies.

- Future trends, including new legislation or shifts in the real estate market, can impact property valuations. Staying informed about these trends can be beneficial. Some analysts suggest that… (add relevant insights based on local trends).

- Property tax summary reports may be available, offering a broader overview of tax data in Chelan County. Contact the Assessor’s office for more details.

This information is intended as a general guide. Always consult the official Chelan County Assessor website or contact the office directly for the most up-to-date details.

- Revolution Space: Disruptive Ion Propulsion Transforming Satellites - April 24, 2025

- Race Through Space: Fun Family Game for Kids - April 24, 2025

- Unlocking the Universe: reading about stars 6th grade Guide - April 24, 2025