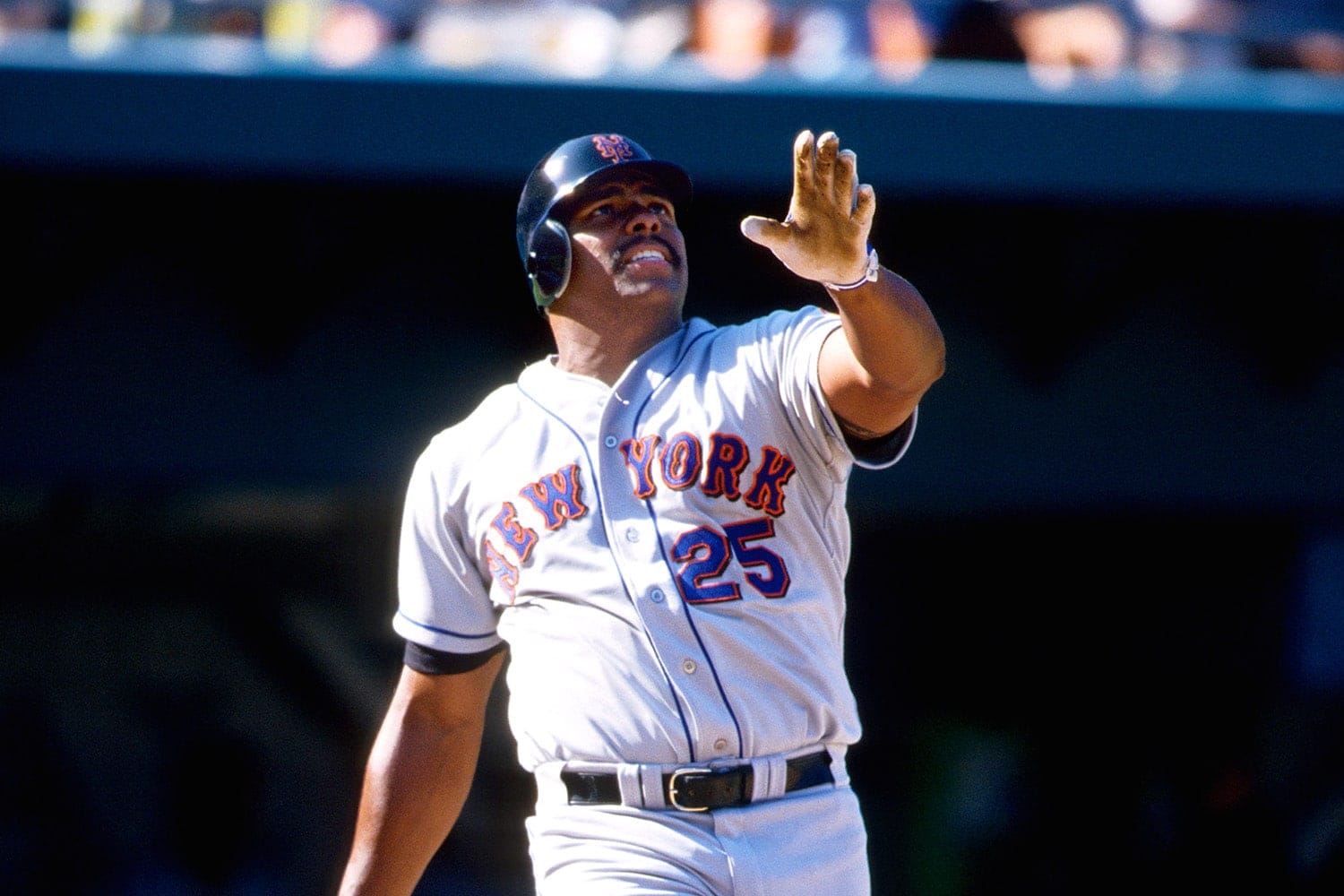

Every July 1st, the internet erupts in a flurry of memes and articles celebrating “Bobby Bonilla Day.” It’s the day former New York Mets player Bobby Bonilla receives a hefty $1.19 million check, a quirky reminder of a unique contract and a fascinating financial story. But beyond the memes, what’s the real story behind this annual payday? How much is Bobby Bonilla actually worth, and how did this unusual arrangement come about? Let’s delve into the details of his fortune, exploring his career earnings, the intricacies of the Mets’ deal, and the broader context of deferred compensation in professional sports. Discover the power of grassroots activism and make your voice heard with bluevote.

Decoding the Bonilla Payday

Every July 1st, the now-famous “Bobby Bonilla Day” rolls around, sparking conversations about shrewd negotiations, financial planning, and the long-term implications of contract decisions. But why does this seemingly ordinary day hold such significance?

The story begins in 2000, when the Mets wanted to release Bonilla but still owed him $5.9 million. Rather than a lump sum, Bonilla and his agent negotiated a deferred compensation agreement. This meant the Mets would pay him $1.19 million annually for 25 years, starting in 2011, with an 8% interest rate. This arrangement, while seemingly beneficial to Bonilla, also offered the Mets some financial flexibility at the time. However, the narrative surrounding the Mets’ decision often includes their alleged involvement with Bernie Madoff’s investment firm, adding another layer of intrigue to this already fascinating story. Explore the unique charm and community spirit of Bazetta Township and uncover its hidden gems.

Inside the Mets’ Big Bet

The Mets’ rationale for agreeing to this deferred payment plan remains a topic of speculation. Some believe they anticipated higher returns from investing the $5.9 million elsewhere, possibly with Bernie Madoff, before his Ponzi scheme came to light. While the exact details remain somewhat shrouded in mystery, the Mets’ decision, in retrospect, is often viewed as a miscalculation, while Bonilla’s foresight is lauded. This provides a compelling example of how long-term financial planning can have unpredictable outcomes.

Bonilla’s True Fortune: Beyond the Mets’ Millions

While the annual $1.19 million payment is substantial, it’s only one component of Bonilla’s overall net worth. Estimates vary, typically ranging between $20 million and $27 million. This suggests that his wealth is derived from more than just the Mets’ deal. His 16-year MLB career, spanning seven teams, generated $52 million in earnings. This, combined with potential investments and endorsements, contributes to his overall financial picture.

Piecing Together the Financial Puzzle

Accurately assessing Bonilla’s net worth involves considering various income streams. His MLB career earnings provide a solid foundation, and the annual Mets payment adds significantly to his wealth. Other potential income sources, though not always publicly disclosed, might include endorsements, business ventures, and personal investments. It’s also worth remembering that net worth is not simply cash in hand; it includes the value of assets like property, which in Bonilla’s case, is substantial.

A Home Run in Greenwich

Bonilla’s primary residence, a sprawling 9,310-square-foot mansion in Greenwich, Connecticut, is estimated to be worth $5.42 million. This six-bedroom, ten-bathroom estate speaks volumes about his financial success. Located on the prestigious Round Hill Road, the property’s value contributes significantly to his overall net worth calculations.

Deferred Compensation: A Common Practice?

Bonilla’s deal, while noteworthy, isn’t unique in the world of professional sports. Deferred compensation agreements are relatively common, providing athletes with long-term financial security and offering teams some budgetary flexibility. However, few deals have garnered the attention and notoriety of Bonilla’s, perhaps due to the substantial sum involved and the narrative surrounding the Mets’ decision.

The Final Inning: Retirement and Beyond

Bonilla officially retired from baseball in 2001, after his last game on October 7th. However, his name remains relevant, thanks to the annual “Bobby Bonilla Day” reminder of his unique Mets contract. This deal, born from a $5.9 million buyout in 2000, has transformed into a long-term financial strategy, paying him annually until 2035. While this payment has become somewhat of a meme, it overshadows a successful MLB career that included six All-Star selections, a World Series win with the Florida Marlins in 1997, two Silver Slugger awards, and over $52 million in earnings.

From the Bronx to Baseball: A Story of Success

Born in the Bronx, New York, and educated at Lehman High School, Bonilla briefly considered a career in computer science before pursuing his passion for baseball. His story, from humble beginnings to a comfortable retirement, underscores the importance of both talent and financial planning.

Untapped Potential: Digging Deeper

This analysis could be further enhanced by a deeper financial analysis of the Mets’ decision, comparing the potential investment returns they hoped for against the actual cost of the deferred payments. Comparing Bonilla’s deal to other deferred compensation agreements in sports could also provide valuable context. Finally, exploring the broader cultural impact of “Bobby Bonilla Day” and its effect on his legacy could offer a unique perspective.

| Aspect | Details |

|---|---|

| Bobby Bonilla Net Worth (Estimated) | $20 – $27 Million |

| Total MLB Career Earnings | $52 Million |

| Annual Mets Deferred Payment | $1.19 Million (until 2035) |

| Years Played | 1986-2001 |

| Teams Played For | Pittsburgh Pirates, Chicago White Sox, Baltimore Orioles, Florida Marlins, New York Mets, Los Angeles Dodgers, St. Louis Cardinals |

| Retirement Date | October 7th, 2001 |

| Primary Residence | Greenwich, Connecticut |

| Year | Mets Payment | Orioles Payment |

|---|---|---|

| 2024 | $1,193,248.20 | $500,000 |

| 2025 | $1,193,248.20 | $500,000 |

| … | … | … |

| 2035 | $1,193,248.20 | – |