NCREIF: The Gold Standard for U.S. Commercial Real Estate Performance Data. But what exactly is NCREIF, and why does it matter? This comprehensive guide decodes the National Council of Real Estate Investment Fiduciaries, exploring its role, data, impact, and future in the world of institutional real estate investment.

Exploring NCREIF’s Role in the Real Estate Ecosystem

Unlocking Real Estate Insights: How NCREIF Data Empowers Informed Investment Decisions. Imagine trying to navigate the complex world of commercial real estate investment without a reliable map. NCREIF provides that map, offering crucial data and benchmarks that empower institutional investors to make informed decisions. This section delves into NCREIF’s core functions and how they contribute to a more transparent and efficient market.

What is NCREIF?

NCREIF is a non-profit trade association dedicated to serving the institutional real estate investment community. For over 40 years, it has acted as a central hub for collecting, validating, aggregating, and analyzing data on the performance of U.S. commercial real estate. This data-driven approach helps investors assess risk, identify emerging opportunities, and benchmark their performance against industry peers.

What Does NCREIF Do?

NCREIF’s primary function is to provide transparent performance data and indices for the U.S. commercial real estate market. Data-contributing members submit information, which NCREIF meticulously analyzes and transforms into valuable indices and data products. This process enables investors to benchmark their performance, understand market trends, and ultimately make more informed decisions.

Key Data and Indices: Illuminating Market Performance

NCREIF offers a suite of tools designed to shed light on the complexities of the commercial real estate market. Here are some of the most significant:

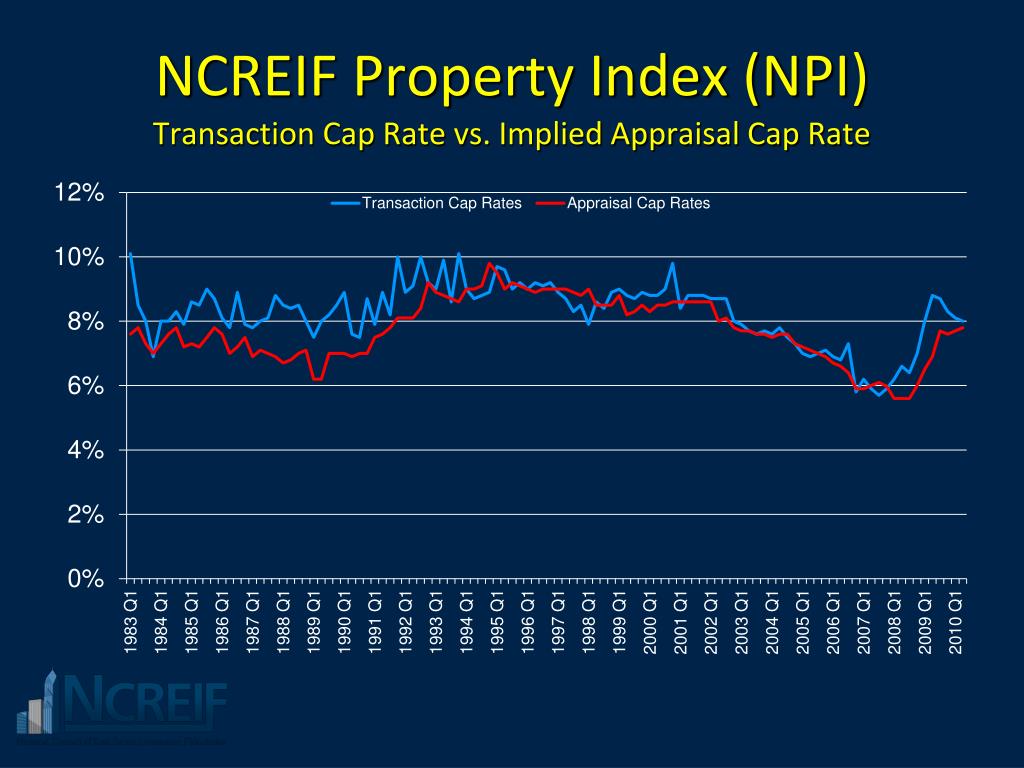

- NCREIF Property Index (NPI): This quarterly, unleveraged composite total return index is a cornerstone of the industry, tracking the performance of private commercial real estate properties. It’s a vital benchmark for institutional investors seeking to understand long-term trends and evaluate their portfolio performance.

- NFI-ODCE (Open-End Diversified Core Equity): This capitalization-weighted index focuses on open-end funds employing a core investment strategy. It provides comparative performance data, essentially offering a scorecard for these specific funds.

- Farmland and Timberland Data: Recognizing the growing interest in alternative investments, NCREIF also gathers and analyzes data on farmland and timberland, broadening the scope of available market insights.

- Custom Analytics and Query Tools: Understanding that each investor has unique needs, NCREIF offers tailored analytics and query tools, empowering members to conduct specific research and extract the precise information they require.

| Data Product | Description | Frequency |

|---|---|---|

| NCREIF Property Index (NPI) | Tracks historical performance of private commercial real estate held by institutional investors, providing a key market benchmark. | Quarterly |

| NFI-ODCE | Benchmarks investment returns of open-end core strategy funds, offering comparative performance data. | Quarterly |

| Farmland & Timberland Data | Provides performance insights into these alternative real estate asset classes. | Quarterly |

| Custom Analytics | Offers tools for tailored data analysis, meeting specific research needs. | Varies |

Decoding NCREIF Membership: Who Qualifies and What are the Benefits?

Beyond Benchmarks: NCREIF’s Expanding Influence on the Institutional Real Estate Landscape. NCREIF unites over 200 institutional real estate professionals, fostering data transparency and industry best practices. But who are these members, and what advantages do they gain? This section explores the NCREIF membership ecosystem, highlighting the different tiers, benefits, and collective impact on the industry.

Who are the Members of NCREIF?

NCREIF’s membership is a diverse mix of professionals dedicated to understanding and shaping the real estate investment landscape. The core membership consists of Data-Contributing Members, typically institutional investment managers overseeing real estate portfolios exceeding $50 million in assets. These members provide the crucial data that fuels NCREIF’s insights. Other membership categories likely exist (further investigation on NCREIF’s official website is recommended) to cater to professionals such as academics, consultants, and service providers, contributing unique perspectives and enriching the overall knowledge base.

Why Join NCREIF? Unlocking a Wealth of Resources

Membership in NCREIF offers a range of benefits, including:

- Access to Exclusive Data: Members gain access to valuable resources like the NCREIF Property Index (NPI), the Fund Index, and other specialized data products. This data empowers them to make more informed investment decisions and stay ahead of market trends.

- Networking and Collaboration: NCREIF fosters a vibrant community through conferences, workshops, and committee memberships. These opportunities connect members with industry leaders, enabling valuable knowledge sharing and relationship building.

- Professional Development: The NCREIF Academy offers educational resources and training programs, equipping members with the skills and knowledge needed to thrive in a constantly evolving market.

- Influence on Industry Standards: Members contribute to shaping industry best practices through participation in committees and task forces. This collaborative approach fosters greater transparency and professionalism within the real estate investment sector.

| Membership Type | Description | Requirements | Key Benefits |

|---|---|---|---|

| Data-Contributing Member | Provides data to NCREIF’s database | Manages a real estate portfolio over $50 million | Access to all NCREIF data, networking opportunities, influence on industry practices |

| Associate Member | Accesses NCREIF resources and networking | Varies | Access to select NCREIF data and networking events |

NCREIF’s Impact: Shaping the Future of Real Estate Investment

NCREIF members actively contribute to the evolution of the real estate investment industry. By providing data, sharing insights, and participating in committees, they help establish industry standards, promote transparency, and drive best practices. This collective effort strengthens the market and benefits investors and the broader economy.

NCREIF’s Future: Adapting to a Changing Landscape

NCREIF is committed to remaining at the forefront of the real estate investment industry. As the market continues to evolve, NCREIF probably will adapt by incorporating new technologies, expanding its data sets, and exploring emerging trends. This dedication to innovation ensures that NCREIF remains a vital resource for institutional investors navigating the complexities of the real estate market.

What Does NCREIF Stand For?

NCREIF stands for the National Council of Real Estate Investment Fiduciaries. This non-profit organization plays a critical role in providing transparency and reliable performance data for the U.S. commercial real estate market. It primarily serves institutional investors, such as pension fund managers, investment advisors, researchers, and consultants, who rely on NCREIF data for informed decision-making.

Key Takeaways: Understanding NCREIF’s Importance

- NCREIF is a non-profit organization: Dedicated to providing transparent and reliable performance measurement data for the US commercial real estate market.

- Data-Driven Decision Making: NCREIF data empowers institutional investors to make informed investment choices.

- Key Beneficiaries: Pension fund managers, investment advisors, researchers, and consultants utilize NCREIF data and resources.

- NCREIF Property Index (NPI): Industry standard benchmark for tracking historical performance of private commercial real estate held by institutional investors.

- NFI-ODCE: Benchmarks open-end diversified core equity funds.

- Farmland and Timberland Data: Expands data coverage to alternative real estate investments.

- Custom Analytics and Query Tools: Allows members to perform tailored data analysis.

- Membership Benefits: Access to data, exclusive events, networking opportunities, educational resources through the NCREIF Academy.

- Overall Impact: NCREIF promotes market stability and efficiency by empowering data-driven decision making.

Delve into the legal concept of in pari delicto and uncover its implications. Explore the wealth of information available through BRB Publications public records and expand your knowledge.

- Atlanta Fajr Prayer Times: A Comprehensive Guide for 2024 - December 4, 2024

- Buffalo Prayer Times: Current Salah Schedule & Monthly Timetable - December 4, 2024

- Atlanta Fajr Prayer Times: A Comprehensive Guide (2025) - December 4, 2024