Dealing with the Mahoning County Probate Court can be challenging, especially during a time of loss. This comprehensive guide provides clear, step-by-step instructions and valuable resources to help you navigate the probate process effectively. Whether you’re handling a simple will or a complex inheritance, this guide offers the information you need.

Understanding Mahoning County Probate

What is Probate?

Probate is the legal process of settling a deceased person’s affairs. This includes validating the will (if one exists), paying outstanding debts and taxes, and distributing the remaining assets to the rightful heirs. In Mahoning County, probate is generally required if the deceased owned real estate or significant personal property solely in their name, including bank accounts exceeding a certain limit set by Ohio law. Smaller estates may qualify for simplified procedures, which this guide will also address.

Why is Local Expertise Important?

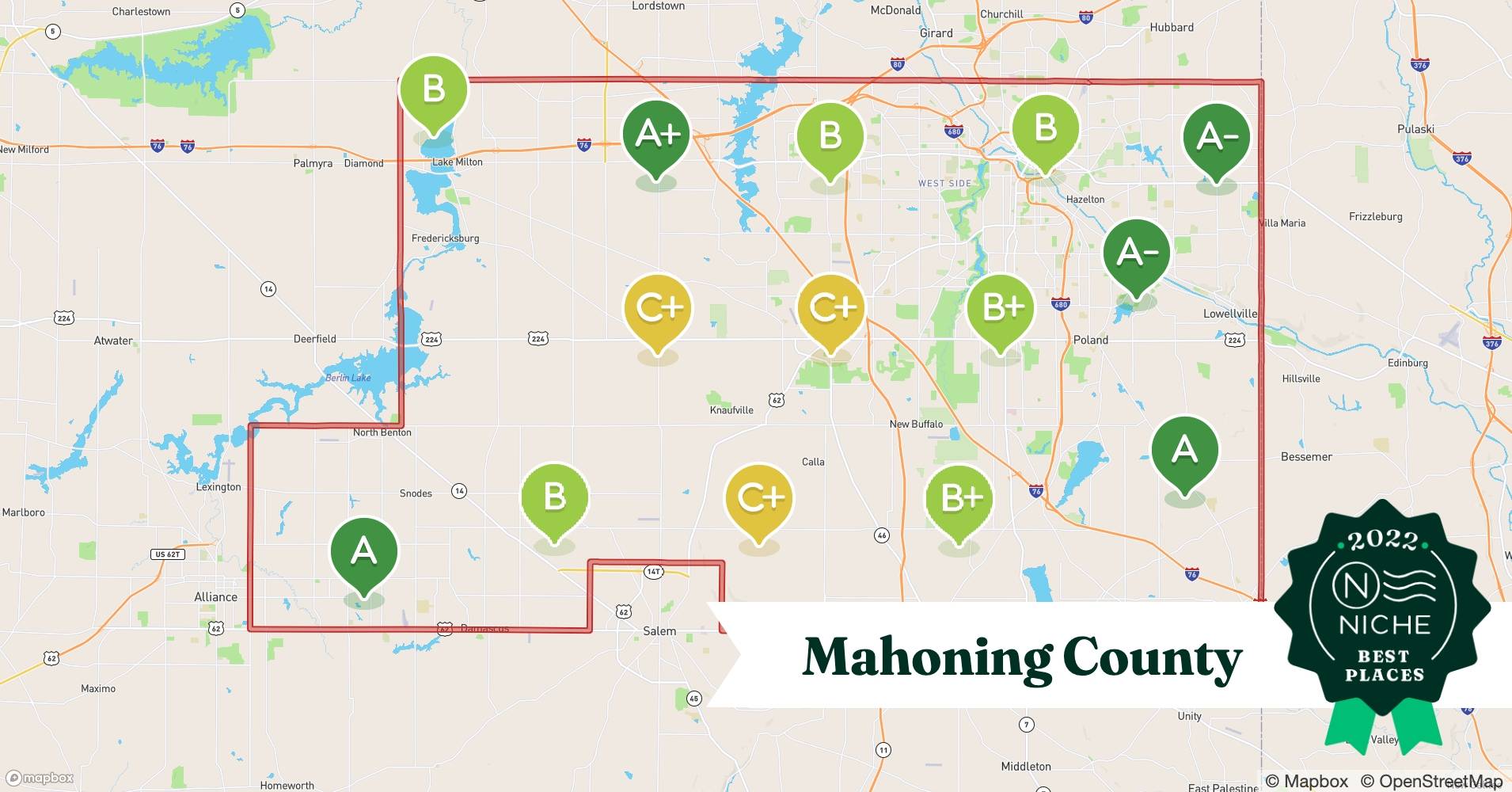

Mahoning County, like other Ohio counties, has specific local rules and procedures that may differ from general state guidelines. Using the correct forms and following the proper procedures is crucial for a smooth and efficient probate process. This guide focuses specifically on Mahoning County, providing tailored information and resources to help you navigate the local probate system.

The Probate Process: A Step-by-Step Guide

While each estate is unique, the probate process in Mahoning County generally follows these key steps:

1. Initiating Probate

The process begins by filing the will (if there is one) and a petition for probate with the Mahoning County Probate Court. This petition formally notifies the court of the death and initiates the probate proceedings. The correct forms for Mahoning County can be found on the court’s website.

2. Appointing an Executor or Administrator

The court appoints an individual to manage the estate. This person is called the executor if named in the will, or the administrator if appointed by the court. This individual is responsible for carrying out the terms of the will or, if there is no will, distributing assets according to Ohio intestacy laws.

3. Inventorying Assets

A comprehensive inventory of all the deceased’s assets—including bank accounts, real estate, personal property, investments, and more—must be compiled and filed with the court. This detailed record ensures accurate accounting and proper distribution of the estate.

4. Settling Debts and Taxes

The executor or administrator uses estate funds to pay any outstanding debts, taxes, and administrative expenses. This includes notifying creditors and settling any valid claims against the estate.

5. Distributing Remaining Assets

After all debts and taxes are paid, the remaining assets are distributed to the beneficiaries named in the will or, if there is no will, according to Ohio’s intestacy laws.

Timeframes and Costs

The duration and cost of probate vary depending on the complexity of the estate. Simple estates may be settled relatively quickly, while more complex cases can take a year or more. Costs can include court fees, attorney fees (if you choose to hire one), and other administrative expenses. The Mahoning County Probate Court website provides details on current fees.

Essential Resources

Mahoning County Probate Court Website

The official website (mahoningcountyoh.gov/962) offers a wealth of information, including:

- Required Forms: Downloadable forms specific to Mahoning County, including the petition for probate, inventory forms, and various affidavits and applications.

- Fee Schedules: Details on current court fees and associated costs.

- Local Rules: Specific rules and procedures for Mahoning County probate cases. Understanding these rules is critical for a smooth process.

- Probate Estate Help/Instruction Sheet: A helpful guide to procedures and fees.

- Information on the New Case Management Software: As of June 28, 2024, the court utilizes new case management software. The website provides details on how this change may affect filing requirements and procedures.

Probate Court Help Desk

The Mahoning County Probate Court offers a Help Desk specifically for small estates. This free service provides assistance and answers to common questions. The Help Desk is available Tuesdays from 1:00 PM to 3:00 PM at the court’s location: 120 Market Street 1st Floor, Youngstown, OH 44503.

Legal Counsel

While some individuals handle simple estates without an attorney, hiring a qualified probate attorney can provide peace of mind, especially in complex cases or if disputes arise. An attorney can help ensure compliance with all legal requirements and advocate for your best interests. Resources like Co-op Legal Services and The Law Superstore can help you find legal assistance. You can also find helpful books on probate on Amazon.

Additional Information

Historical Probate Records

Mahoning County probate records dating back to 1846 are available for genealogical research through various online platforms, including Family Search.

Accessibility

The Mahoning County ADA Transition Plan and Accessibility Design Guidelines ensure that court services are accessible to everyone, regardless of disability.

Do-It-Yourself Probate: Proceed with Caution

While services like “You Can Do Probate” exist, navigating Ohio probate law without professional guidance can be risky. Consulting with an experienced probate attorney, especially in complex cases, is highly recommended to avoid potential pitfalls and ensure compliance with legal requirements. Remember, the information provided in this guide is for general informational purposes only and does not constitute legal advice. Consulting with a qualified attorney is always recommended for specific legal guidance.

Unveil the intricate workings of the Mahoning County Probate Court and delve into the captivating story of Mary Ryan Ravenel, a figure whose life is shrouded in mystery and intrigue.

- Ultimate Guide to Words Starting With GO: Comprehensive List - April 4, 2025

- Master words that start with o to describe someone: A complete guide - April 4, 2025

- Master Managing Information Services: A Practical Guide - April 4, 2025

2 thoughts on “Navigating Probate in Mahoning County, Ohio: A Practical Guide”

Comments are closed.