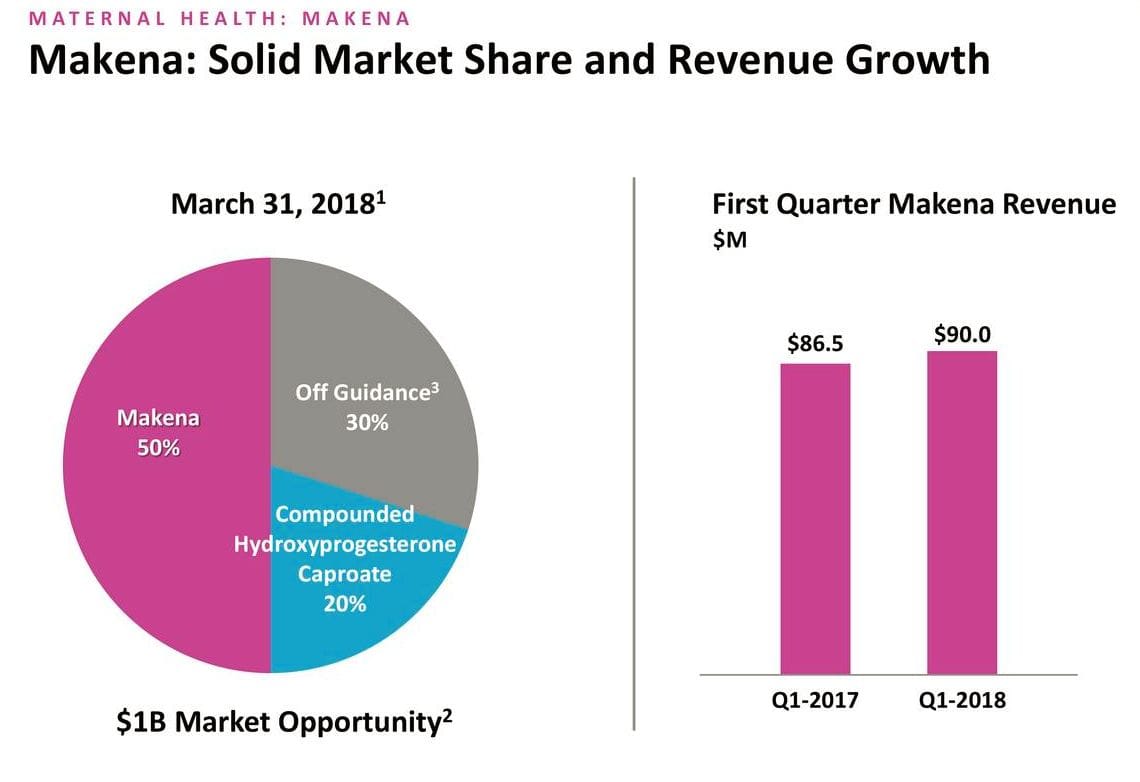

Understanding Makena Capital’s Endowment-Style Approach

Makena Capital, founded in 2005 by seasoned professionals from Stanford Management Company, specializes in endowment-style investing. This approach, often used by universities and large charities, focuses on long-term, sustainable growth rather than short-term gains. Midway Motors and Midway Motors Newton exemplify businesses with long-term visions, much like Makena’s investment philosophy. Makena leverages its deep understanding of generational wealth management to help organizations navigate the complexities of long-term investing.

What is Endowment-Style Investing?

Endowment-style investing emphasizes diversification across a wide array of assets, especially “alternative investments” like private equity, venture capital, real estate, and natural resources. This strategy aims to mitigate risk and potentially achieve higher returns compared to traditional stock and bond investments. Makena Capital excels at constructing portfolios designed to weather market volatility and deliver sustained growth over extended periods.

Serving Families and Institutions

Beyond institutional clients, Makena Capital also caters to wealthy families through its “Home B” program. This program offers comprehensive wealth inheritance and management services, assisting families with the intricacies of wealth transfer and legacy planning. It goes beyond mere financial management, ensuring the family’s values and philanthropic goals are upheld across generations. Much like choosing a reliable car dealership like Midway Motors Newton, selecting a trustworthy wealth manager is crucial for long-term success.

Thought Leadership and Innovation

Makena Capital actively contributes to the investment industry’s understanding of best practices. Larry Kochard, a recognized expert in endowment-style investing, is a key figure at Makena and frequently shares his insights. The firm acts as an outsourced Chief Investment Officer (OCIO) for organizations lacking the resources or expertise to manage their investments internally. This allows clients to focus on their core missions while benefiting from Makena’s specialized knowledge. Just as Midway Motors provides expert guidance in the automotive world, Makena offers specialized financial expertise.

Looking forward, Makena Capital is likely exploring new investment avenues, such as ESG (Environmental, Social, and Governance) and impact investing. These strategies aim to generate positive social and environmental impact alongside financial returns. This forward-thinking approach suggests Makena’s continued commitment to innovation and adapting to evolving client needs. While there is ongoing research into the long-term efficacy of these strategies, some experts believe they represent the future of responsible investing. This innovative approach mirrors businesses like Midway Motors Newton that adapt to changing customer demands.

Decoding Mudrick Capital: Distressed Investing & Special Situations Expertise

Mudrick Capital distinguishes itself by specializing in distressed investing and special situations. They identify undervalued companies or assets, often facing challenges, and leverage their expertise to revitalize them. This active, hands-on approach involves in-depth analysis, strategic interventions, and a willingness to take calculated risks.

Distressed Investing and Special Situations: A Closer Look

Distressed investing targets companies struggling with debt, market downturns, or internal issues. Mudrick Capital identifies these companies with underlying value and implements strategies to help them recover. Their special situations strategy extends to mergers, restructurings, and bankruptcies, where they navigate complex scenarios to identify opportunities for maximizing returns.

An Activist Approach

Unlike passive investors, Mudrick Capital takes an activist stance. They utilize their ownership stake to influence companies, advocating for management changes, strategic shifts, or challenging board decisions. Their involvement with companies like Verso Corporation and Globalstar demonstrates their proactive approach to driving positive change and enhancing shareholder value.

Performance and Risk

Mudrick Capital’s historical performance is notable, with their Distressed Opportunity Fund achieving top rankings in 2016. However, investing in distressed assets and special situations carries inherent risks. Market conditions can shift rapidly, and losses are possible even for skilled investors. While Mudrick Capital’s track record suggests expertise, future investments may not replicate past returns.

Key Aspects of Mudrick Capital:

| Key Aspects | Description |

|---|---|

| Focus | Distressed investing and special situations |

| Investment Style | Active and activist |

| Performance | Strong historical track record, including top rankings |

| Assets Under Management | Estimated in the billions of dollars |

The financial landscape is constantly evolving, and Mudrick Capital will probably adapt its strategies as the market changes. Their approach to distressed investing may involve taking on companies like Midway Motors Newton should they ever face financial difficulties, seeking to turn them around for profit.

Who is Highland Capital?

While this article focuses primarily on Makena Capital and Mudrick Capital, information on Highland Capital is essential to provide a comprehensive understanding of the investment landscape. Further research is needed to delve into Highland Capital’s specific operations, investment philosophy, and performance. This will allow for a more detailed comparison and contrast between these firms. It’s important to note that the investment world is complex and ever-changing, and information on firms like Highland Capital, Makena Capital, and even local businesses like Midway Motors, requires ongoing research and updates.

- Unlock Elemental 2 Secrets: Actionable Insights Now - April 2, 2025

- Lot’s Wife’s Name: Unveiling the Mystery of Sodom’s Fall - April 2, 2025

- Photocell Sensors: A Complete Guide for Selection and Implementation - April 2, 2025

1 thought on “Makena Capital: Navigating the World of Endowment-Style Investing”

Comments are closed.